Insights

2024 Digital Assets Study: Is transformation within reach?

Findings from this year’s Digital Assets Study reveal investment institutions’ state of preparedness for digital transformation.

June 2024

James Redgrave

Vice President of Global Thought Leadership

Key findings

- Nearly half of institutions say they are ready to trade digital assets on and off distributed ledgers and blockchains, provided they have the appropriate infrastructure

- Firms see huge growth benefits from tokenized assets and digital infrastructure for increasing revenues and reducing costs

- This could cease the trend of rising costs that are currently putting pressure on profit margins in the investment management industry

- Firms underestimate their peers’ preparedness, suggesting that the wider adoption of trading digital assets on distributed ledgers and blockchains could be coming sooner than anticipated

Our research

In the first quarter of this year, we partnered with Oxford Economics to conduct a survey of 300 investment institutions, including asset managers, asset owners and insurance companies from the Americas, Europe, the Middle East and Africa (EMEA) and Asia Pacific (APAC). We asked them a series of questions about their:

- Current digital asset allocation

- Digital investment strategies

- Assessments of overall industry development

- Broader technology strategies, and how blockchain and tokenization

factor in

The scale of the opportunity

Our research indicates that the revenue and savings benefits anticipated by the investment industry from digital assets and distributed ledger technology (DLT)-based trading and custody are potentially transformational.

Across a wide range of core asset management business areas, from the front, middle and back office, respondents to the third annual State Street Digital Assets Study said they expected major increases in their earnings and reductions in their cost of operations from integrating the technology into their processes.

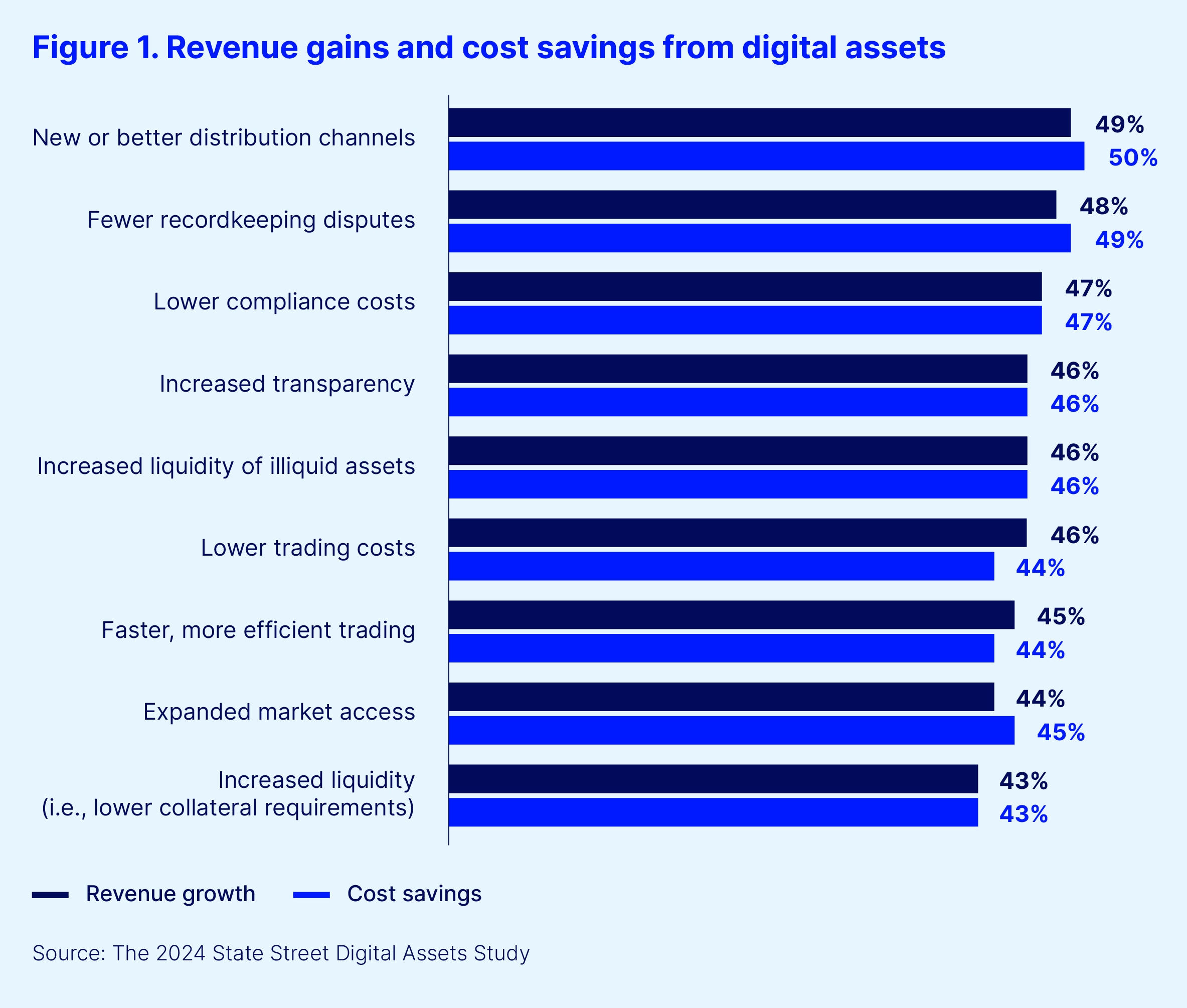

Institutions identified “new and better distribution channels” as the area where they could benefit the most from digital assets, with respondents on average predicting 50 percent cost savings and 49 percent revenue gains1 (see Figure 1).

Costs associated with recordkeeping disputes are projected to decrease by 48 percent, leading to 48 percent revenue increases, while compliance costs are expected to come down 47 percent, driving up revenues by the same amount. Many respondents were even more optimistic in their predictions. A third or more (37 percent, 35 percent and 33 percent respectively) anticipate revenue boosts of 60 percent or higher from improved distribution and compliance, and better record keeping.

Digital strategies: Realizing these opportunities

These numbers could be highly significant for the asset management industry, which has seen its profits impacted by rising costs in recent years, so unsurprisingly, our data shows that the substantial majority of institutions are closely following this space.

Nearly two thirds (62 percent) of those surveyed either have a dedicated digital assets function, or are building one within their organizations, while the majority of the remaining institutions have plans to do so (only 5 percent said they did not). Most respondents were hiring staff with relevant expertise and either integrating them into existing business lines (54 percent) or creating a separate division for digital (46 percent).

However, several also make use of outsourcing (41 percent), buy companies in the space (40 percent) or retrain their existing workforces (40 percent) to equip them with essential digital skills.

Respondents also indicated they were considering a wide network of partners to provide them with services to enable digital assets. More than half were looking to both traditional asset servicing companies (57 percent) and crypto specialist firms (55 percent). However, consultants (49 percent), established technology companies (48 percent) and newer fintechs (44 percent) were also popular choices.

They were particularly keen on looking for support with core areas of digital technology such as DLT or blockchain network creation and maintenance (45 percent), cybersecurity (43 percent), smart contract generation and tokenization of assets (41 percent).

These technology functions surpassed the transference of more traditional financial operations into the digital environment, as fewer respondents prioritized areas like digital fund administration (30 percent), digital distribution (27 percent) and digital custody (27 percent).

Perceptions versus reality: Industry preparedness for digital assets

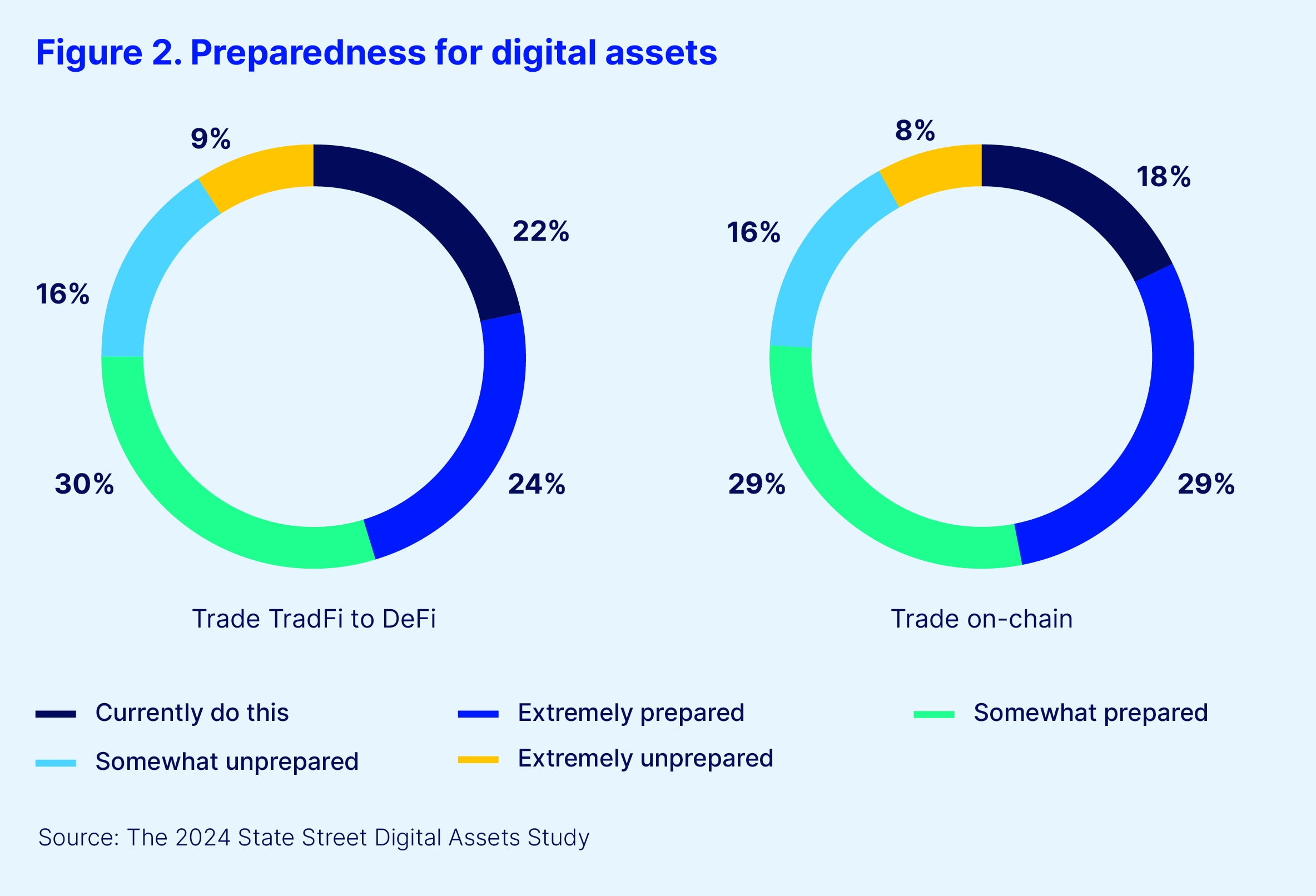

All this preparation left our respondents quite confident in their ability to plug into a digital assets environment once the relevant infrastructure is in place (see Figure 2).

A striking 22 percent said they were already trading assets on-chain, while a further near quarter (24 percent) said they were “extremely prepared” to do so. Similar numbers said they were either already (18 percent) or ready to (29 percent) trade assets on- and off-chain, from traditional finance (TradFi) to decentralized finance (DeFi) and back.

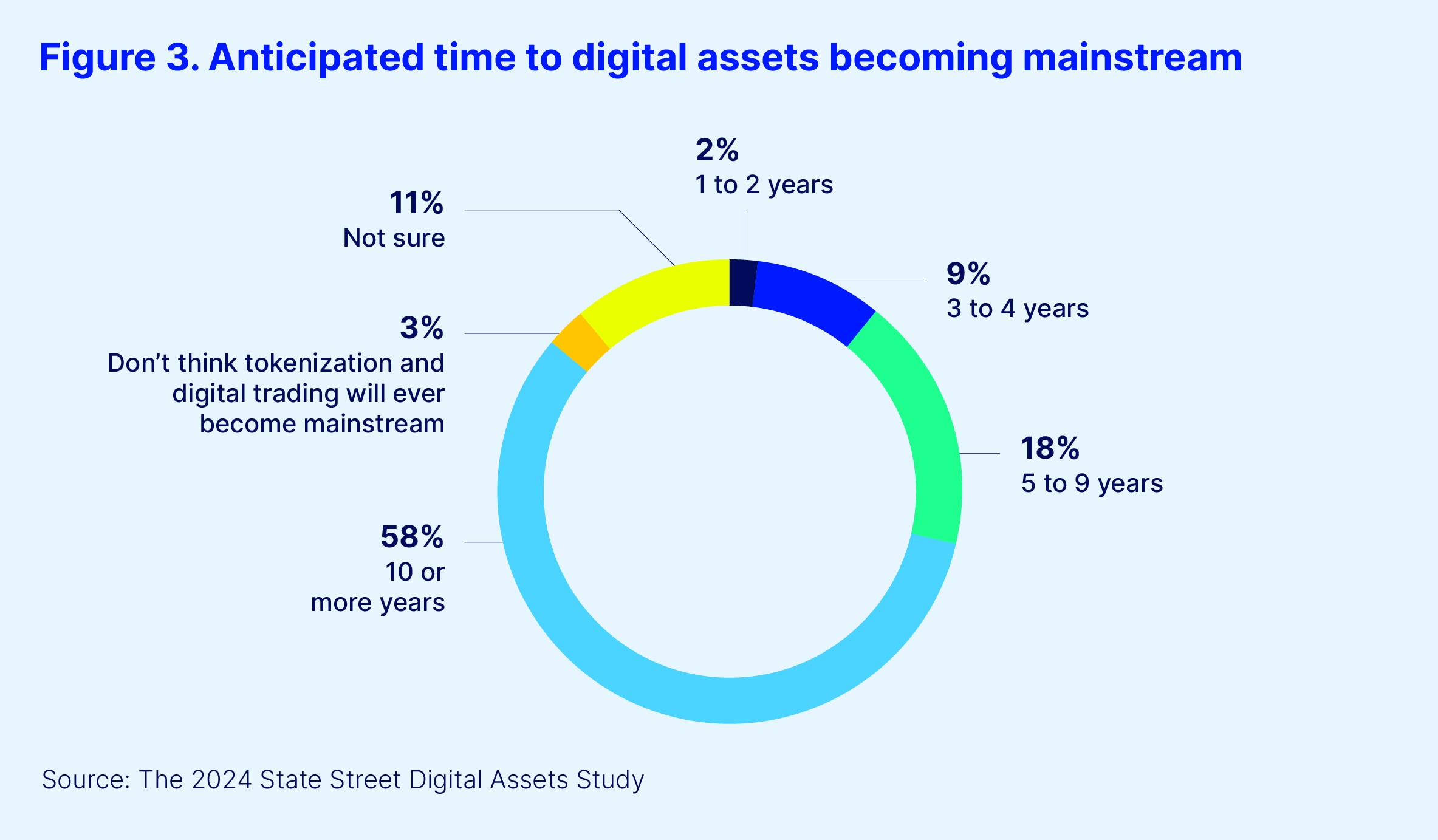

However, when asked about the likelihood of digital assets and this kind of DeFi/TradFi interoperability entering the mainstream, most respondents felt it will take time (see Figure 3). More than half of respondents (58 percent) predicted that it will take at least a decade to become mainstream, compared to only 11 percent who predicted it will take under five years.

Furthermore, nearly three quarters (71 percent) said this kind of hybrid environment between the digital and traditional finance worlds would remain in place for another 10 years or more, before the majority of assets moved on-chain as tokens.

The main reasons cited for this were lack of awareness and demand from buy-side organizations (45 percent), cybersecurity concerns (43 percent), and lack of clarity from regulators and lawmakers, especially in terms of consistent approaches between jurisdictions (39 percent).

Obviously, a lot of the respondents “already doing this” will have done so in experimental, sandbox-type environments – especially moving on- and off-chain – so the large numbers who are well prepared will not necessarily be aware of how many of their peers are advanced at this. This could indicate that this technology is closer to fruition than our respondents expect.

In recent years, asset servicing providers and the technology industry have begun to engage more closely and collaboratively with one another, as well as with the buy side, because of a realization that interoperable blockchains and DLTs cannot be built in silos. As this process gathers speed, it is likely to persuade the respondents that these solutions, and the revenue/cost benefits they can bring, will be realized in the near- to medium-term.

Crypto and the real world: Digital asset allocation

The impact regulators can have on attitudes toward digital assets is highlighted by our asset allocation and investment plans data.

Last year, around a quarter (24 percent) of respondents said Bitcoin and other cryptocurrencies or digitally native assets were the digital asset classes most likely to bring value to their portfolios, compared to 40 percent who said tokenized traditional assets would bring more value.

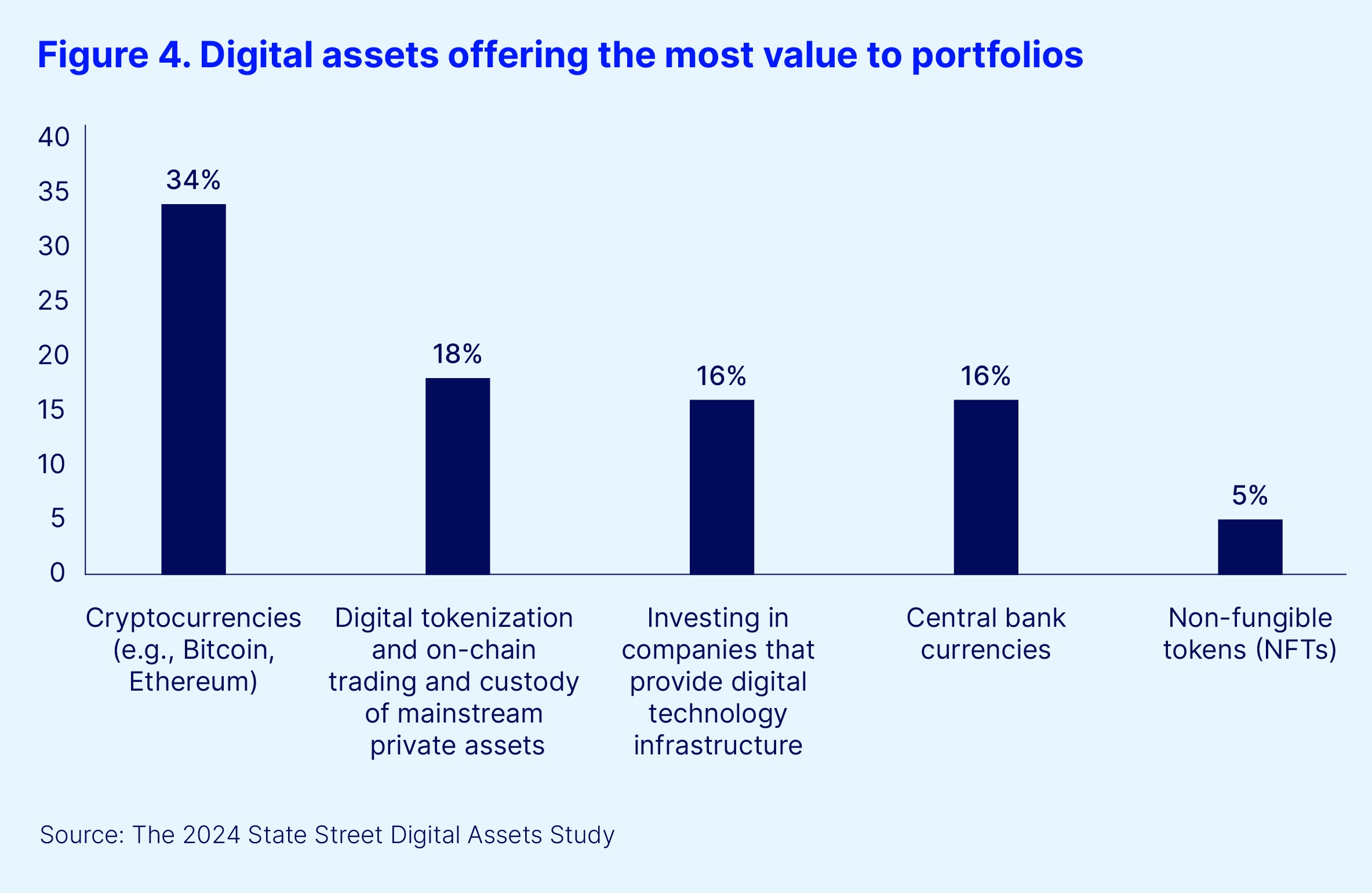

This survey was conducted as the United States Securities and Exchange Commission (SEC) gave its approval for ETFs tracking the spot price of Bitcoin, which led to several launches in the US. This year, a third (34 percent) of respondents picked cryptocurrencies, compared to only 18 percent who opted for tokenized assets (see Figure 4).

Of course, the SEC’s decision was in the headlines for weeks before and after it was made, and new developments will inevitably bring investors’ focus onto new opportunities and areas of digital finance. Nevertheless, many firms seem to recognize the long term value of tokenization. Some 40 percent said their digital asset strategies were focused equally on tokenizing traditional assets, as well as digitally native ones.

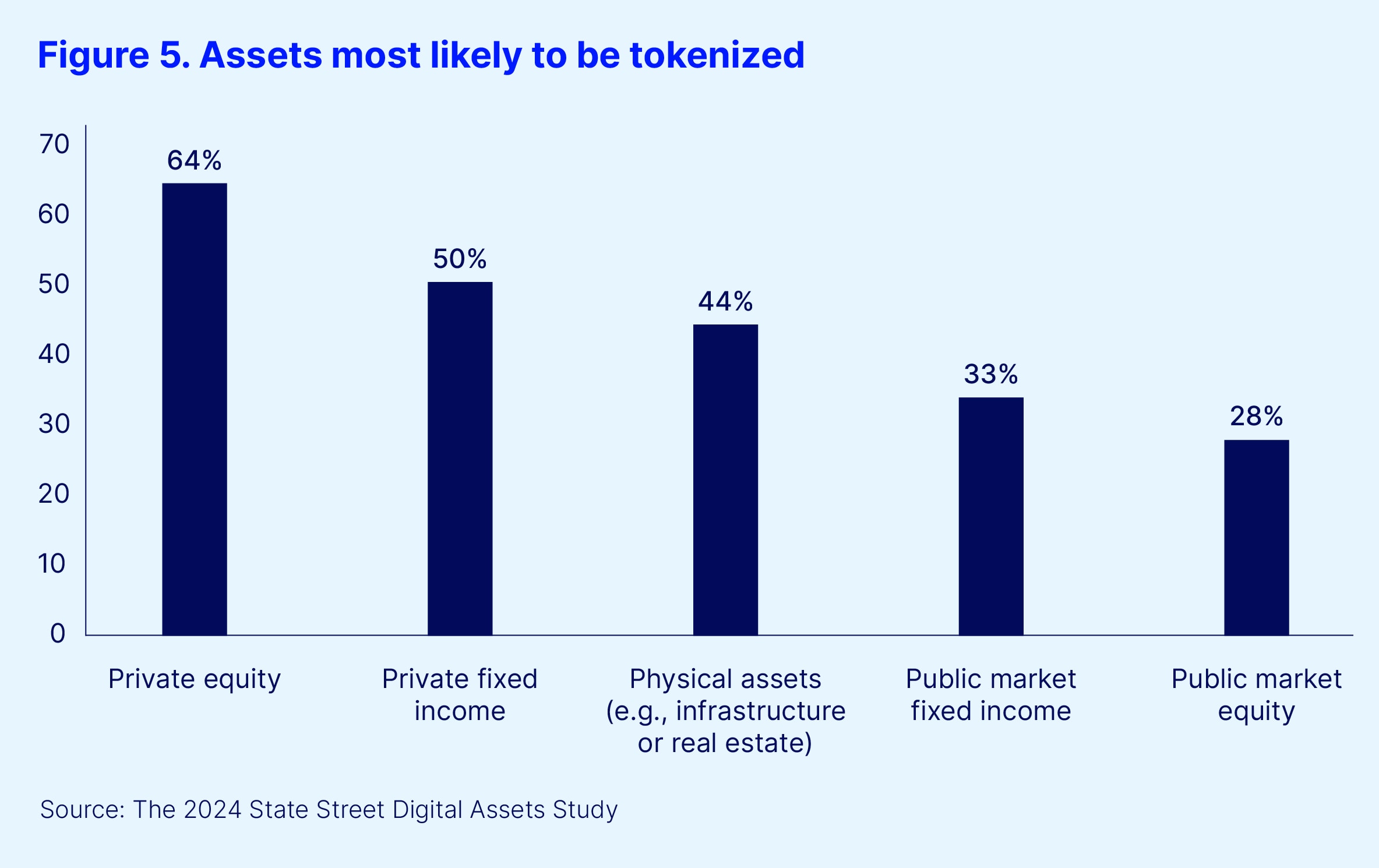

According to our respondents, the most exciting opportunity from tokenized real world assets was in the private markets space. As discussed in our Private Markets Outlook, the move to bring private markets into more liquid portfolios, in order to introduce a wider range of investors to the asset class, is becoming popular, with policy makers across the regions supporting this goal.

Our Digital Assets Study respondents agreed (see Figure 5), with private equity, private debt and physical assets dominating their predictions as to which asset classes would end up being routinely tokenized and traded on DLT.

Where there’s a will…

Although our respondents anticipate that this technology will not embed itself into the financial services mainstream for some time, history suggests that innovations that provide tangible benefits to users receive the necessary investment in time, money and expertise to succeed.

Our research indicates that the industry sees huge potential for this technology to bring them revenues through new investors, and serve them better through lower costs and greater efficiencies. It also shows that the necessary investment to bring digital into the mainstream is already being made. It will be interesting to revisit how close we are to this by this point next year.