Insights

State Street Private Markets Study 2023

In the last few years, the evolution of private markets has been characterized by growth, complexity and expanded scope.

However, in 2022, investors treaded with caution, clearly realizing that the tailwinds of the last decade will not return any time soon. Rising interest rates and the resurgence of inflation have added to the woes of private markets.

We conducted our annual Private Markets Study, gathering responses from over 480 participants across North America, Latin America, Europe and Asia Pacific (APAC) to understand the outlook of asset managers, private markets managers, insurers and asset owners. Through this study, we analyzed the macro environment of private markets, what is driving demand for private markets assets among retail investors, the role of emerging technologies and new fund types. Additionally, we took a deep dive into the role of technology in addressing data management, efficiency and transparency.

Below we share some highlights from the research, with a full report due for release in the coming weeks.

February 2023

Study Highlights

What are the opportunities?

Even though public markets are grappling with a low-yield environment, the private markets space looks positive. According to our study, 68 percent of investors will continue to grow private markets allocations in line with current targets, despite rate rises reducing the attractiveness of leveraged strategies. Private equity will attract the greatest net new investments, while infrastructure has the most widespread backing, i.e., net change, in terms of the largest proportional allocation changes.

Bitter truths – challenges and concerns

There are several factors that hinder the growth of private markets. Rising rates and inflation will have a significant impact on the attractiveness of private markets. 69 percent of firms are in broad agreement that higher rates will lessen the appeal of highly leveraged private assets — a sentiment shared by 81 percent of asset owners. There is a strong push to address operational inefficiency and data management limitations as higher borrowing costs and rising compliance burdens squeeze margins. A volatile economic backdrop puts added emphasis on risk management.

The retail saga

Despite numerous issues and skepticism, many believe that private markets still have much to offer retail investors, suggesting that improved/new products could be used to attract new investors. With a potential influx of retail investors in the private markets space, professional investors expect that governments and regulators will demand greater transparency around this asset class.

All eyes on data

The private markets industry has acquired trillions in assets over the years. However, firms often lack holistic views of their data solutions, as they rely on manual processes and disparate systems. This has created considerable inefficiency in an increasingly complex ecosystem.

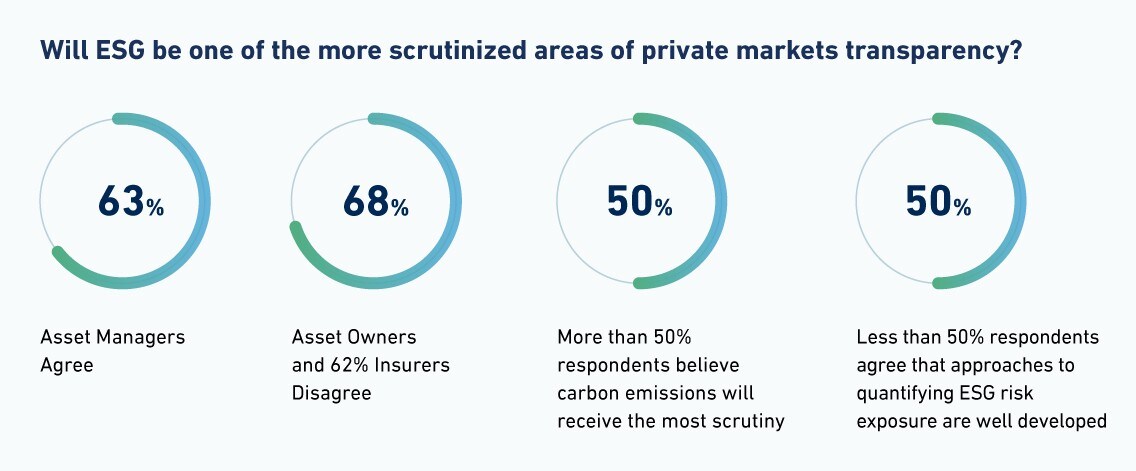

ESG whispers in the private markets corridors

Now more than ever, investors want to invest in companies that make a positive contribution to the environment and society, though it is a tough road to navigate.

Private markets are differently regulated and may not reveal key information that can help investors make informed decisions. Additionally, the lack of information makes it difficult to create a risk and return profile of private markets investments.

Interestingly, our study highlights that private markets provide a better opportunity than public ones when it comes to making an ESG impact. However, the size of private markets, combined with limited oversight implies an increase in the systemic risk.

Our study delves deep into these issues and provides key insights that will define the priorities of asset managers, asset owners and insurers in 2023. How are private markets investors going to ensure the quality of their investments in light of inflation, high valuations and a perceived bubble risk? Will market conditions make it difficult to grow allocations and does that mean that allocation targets are currently changing for the majority of respondents? Institutions are clear about their need to improve due diligence on investments in the future. What type of strategies and partnerships can help institutions focusing on private markets improve their portfolio and investment management outcomes? Deeper perspectives on these areas can inform your 2023 strategy.