Insights

The outsourced trading advantage: Evidence from early adopters

According to our latest survey of 300 institutional investors from around the world, outsourced trading is an emerging trend that is providing investors with a distinct advantage over the rest of the market.

April 2024

Dan Morgan

Head of Portfolio Solutions

Scott Chace

Head of Trading, Portfolio Solutions

Outsourced trading is an evolving strategy that is not widely understood. That’s why, we’ve made it a priority to delve into the market and research experiences with and attitudes toward outsourced trading to provide clarity around the benefits and challenges.

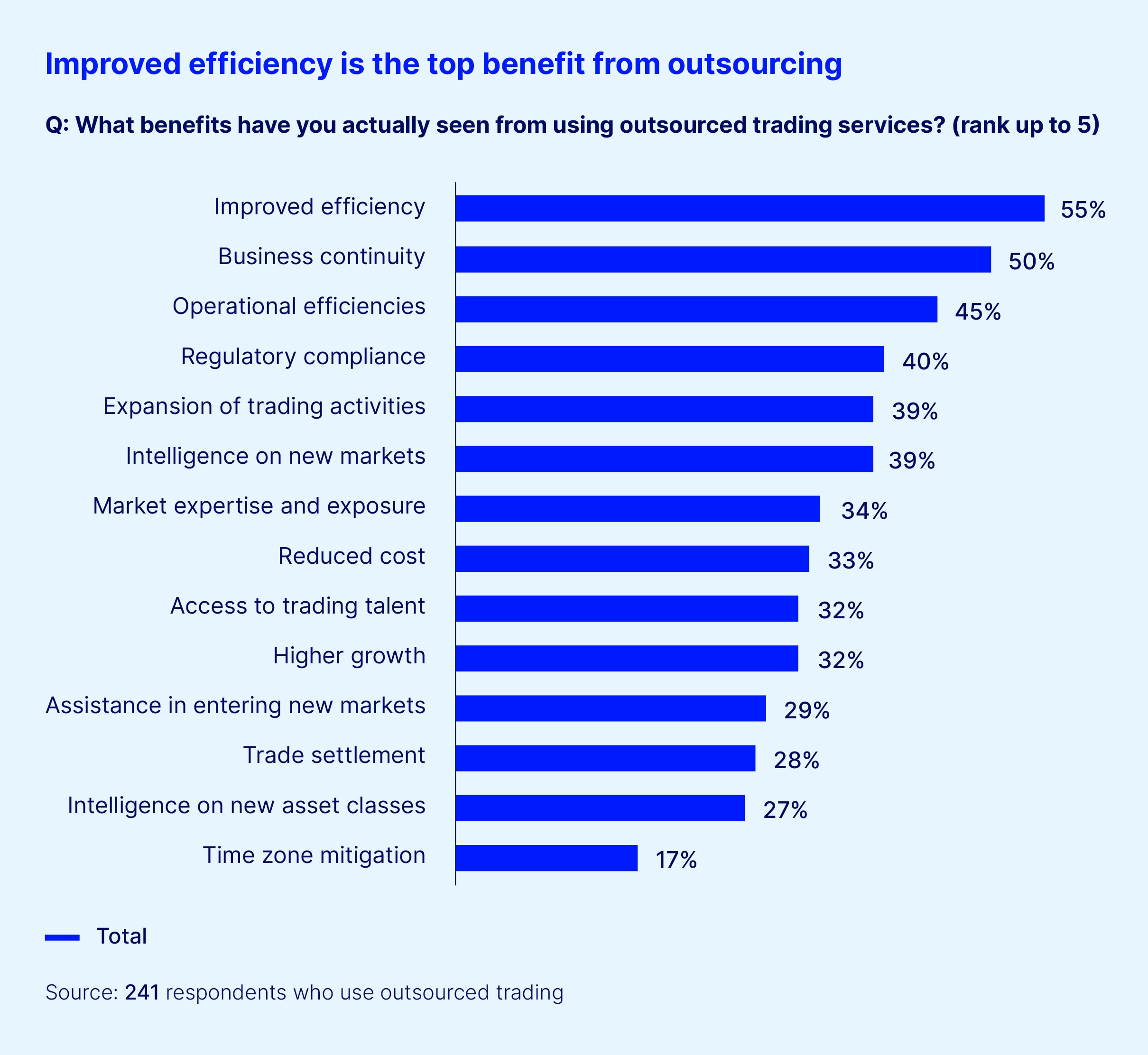

In January, we conducted a survey that we believe is the largest and most comprehensive survey of its kind to date in the industry on outsourced trading. This survey examines the experience of current users and the perception of potential users. While there are many interesting insights from our survey data, our findings around the reported benefits from outsourced trading stand out (see Exhibit 1).

Exhibit 1:

A majority of those already outsourcing report benefits in the form of greater efficiencies, reduced costs and improved investment performance. We also found that respondents report high satisfaction with their experience, with four in five saying they are “satisfied” or “very satisfied.” Yet when we asked potential users about outsourced trading they had reservations, for instance around costs and control, that turn out not to be material to current users.

All this suggests that potential users may have concerns about outsourced trading that are not warranted. What’s more, they may not appreciate the clear advantage that outsourced trading offers to its adopters.