Insights

Integrating ESG considerations into securities lending

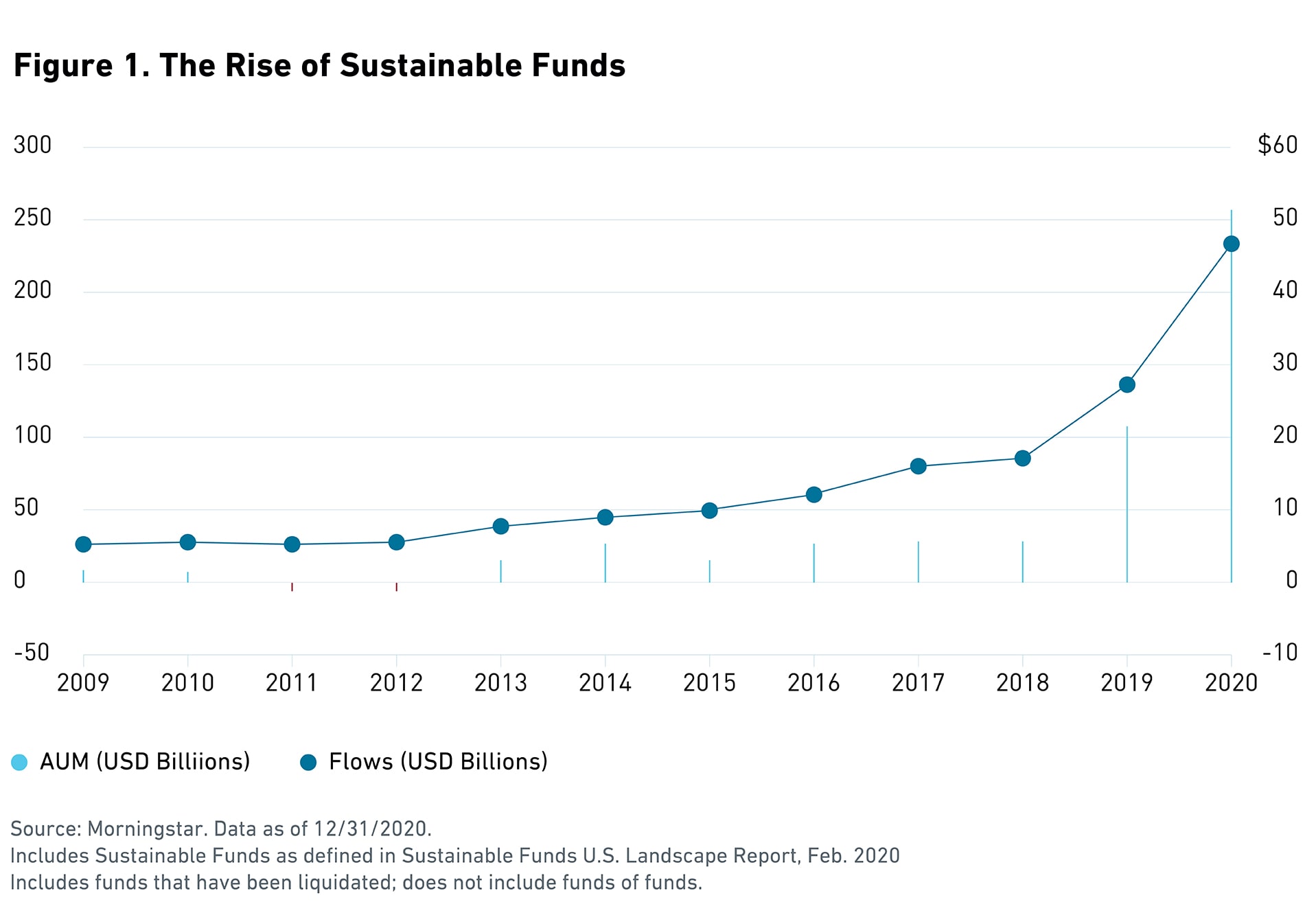

The proliferation of ESG investing over the last decade has given rise to a significant amount of data and wide-ranging, competing frameworks.

June 2021

Yet for many in the securities lending space, reservations about its compatibility with ESG have kept them on the sidelines. As an added challenge, investors must often navigate the space without clear regulatory guidance. Commissioned by the RMA Financial Technology and Automation Committee (FTAC) and authored by State Street Associates, this report takes an academic, data-centric approach to propose a framework that asset owners and agent lenders can use to navigate the integration of ESG into their lending programs.

By aggregating information from existing reports and studies, we clarify the different types of ESG data and their various attributes and challenges, including adoption, coverage, input data sources and metric offerings. We found that market participants are often unsure about how best to align lending programs with their ESG objectives. With an open dialogue on how to balance both lending decisions and ESG philosophies, agent lenders will be in a stronger position to capture a rare opportunity to distinguish their programs from their peers.