Insights

Corporate alignment with the EU taxonomy for sustainable activities

Though sustainable investing has grown in popularity over the past decade, measuring sustainability remains a key challenge.

February 2024

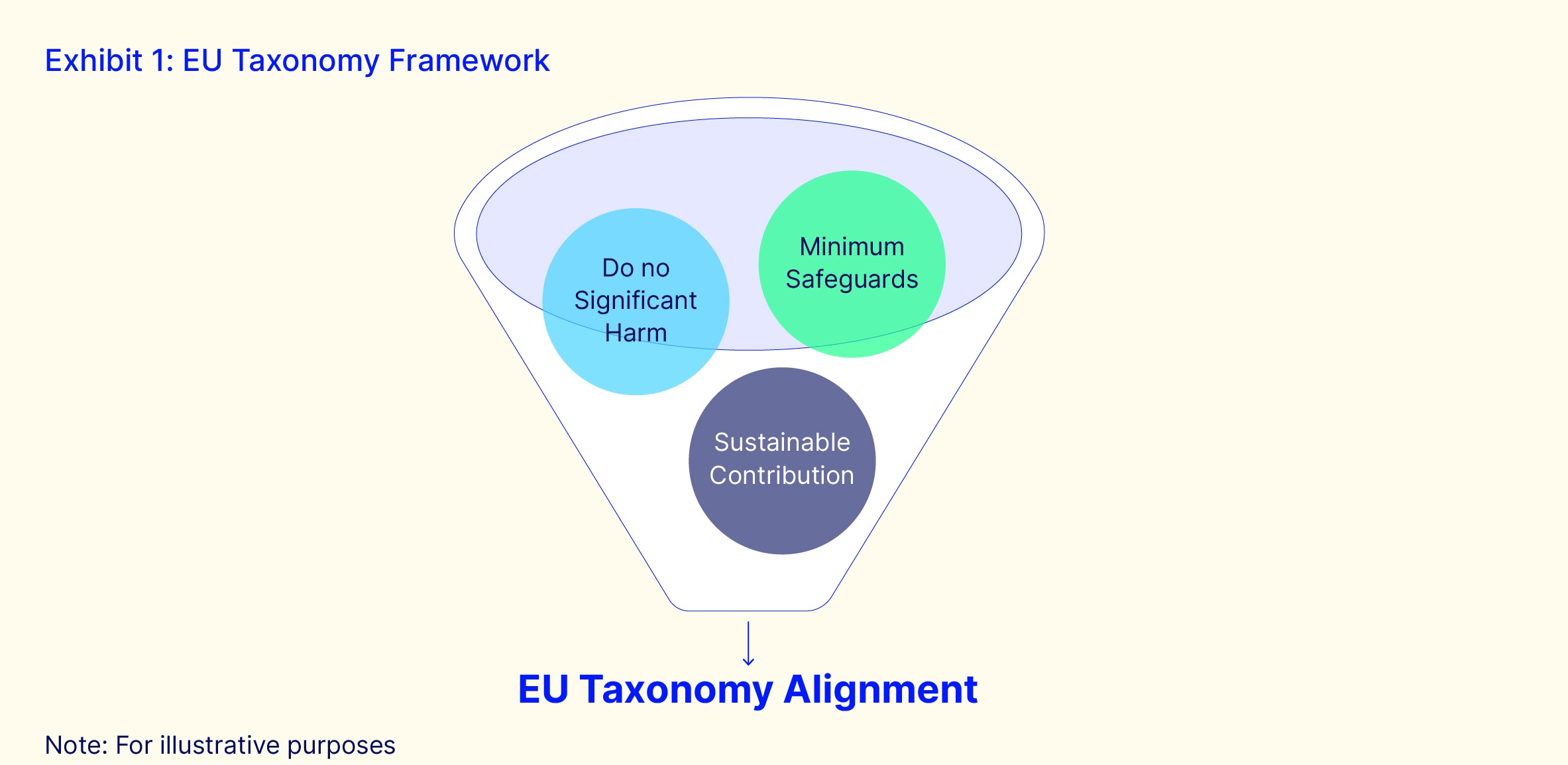

Investors often rely on environmental criteria — such as analyst ratings and carbon emissions — that are insufficient or rely on qualitative analysis. However, for the first time, with the advent of the European Union’s Taxonomy for Sustainable Activities (EU Taxonomy), investors have access to financial accounting data that follows standardized and transparent criteria for quantifying the percentage of a firm’s revenues and expenditures that align with sustainable activities.

In a recent paper, we explore this novel dataset for a cross-section of large European firms, documenting patterns and analyzing how firms’ aligned activities related to fundamentals and environment ratings. We find that the EU Taxonomy data provides information that is distinct from existing sources and offers insights that can help investors and regulators alike.

Key highlights

Trillions of assets have been invested according to various environmental criteria, such as analyst ratings, carbon emissions and more. However, these measures are often insufficient, relying on qualitative analysis or failing to quantifiably relate to a firm’s operating performance.

Now, for the first time, investors can analyze financial accounting data on firms’ sustainable activities. Based on the EU Taxonomy, these data follow standardized and transparent criteria for quantifying the percentage of a firm’s revenues and expenditures that align with sustainable activities.

In our paper, “Corporate Alignment with the EU Taxonomy for Sustainable Activities,” we explore this novel data set for ~327 European firms for fiscal year 2022, the first year of mandated reporting.

First, we analyze patterns in the reported data and find that:

- The EU Taxonomy data is not predicted by existing data (such as Bloomberg estimates for eligible revenues).

- Because of the strict technical criteria set forth by the EU Taxonomy, only a small percentage of business activities align with the taxonomy. Over time, we might expect this gap to shrink as companies transition their investments and products.

- Aligned operating expenditures are associated with aligned revenues. Over time, we might expect this relationship to strengthen as firms translate aligned expenditures into long-term revenues.

Then, we explore the relationship between firms’ aligned activities and fundamentals. We find that the firms with higher alignment exhibit no significant difference in operating performance or valuations. However, this may change in the future, if product and capital markets reward alignment with sustainable activities.

Finally, we evaluate a key objective of the taxonomy, which is to prevent “greenwashing” by firms. To that end, we evaluate the correlations between environmental scores (“E-scores”), carbon intensity and taxonomy alignment of a firm. Notably, we find that many firms with high E-scores have fairly low alignment under the EU Taxonomy framework.

Overall, this suggests that investors and regulators alike may benefit from the EU Taxonomy data. For investors, it can help identify investment opportunities, support due diligence and identify discrepancies between different sustainability frameworks. For regulators, it can help set better public measures and standards for “green” activities and products.