Insights

How do global portfolio investors hedge currency risk?

Investors hedge differently across domiciles and asset classes – but rebalance dynamically to stick with their target hedge ratios.

November 2024

Our proprietary custodial data gives us a uniquely precise view into how investors actually choose to hedge and how that varies over time, by asset class and across different investor domiciles.

Key highlights

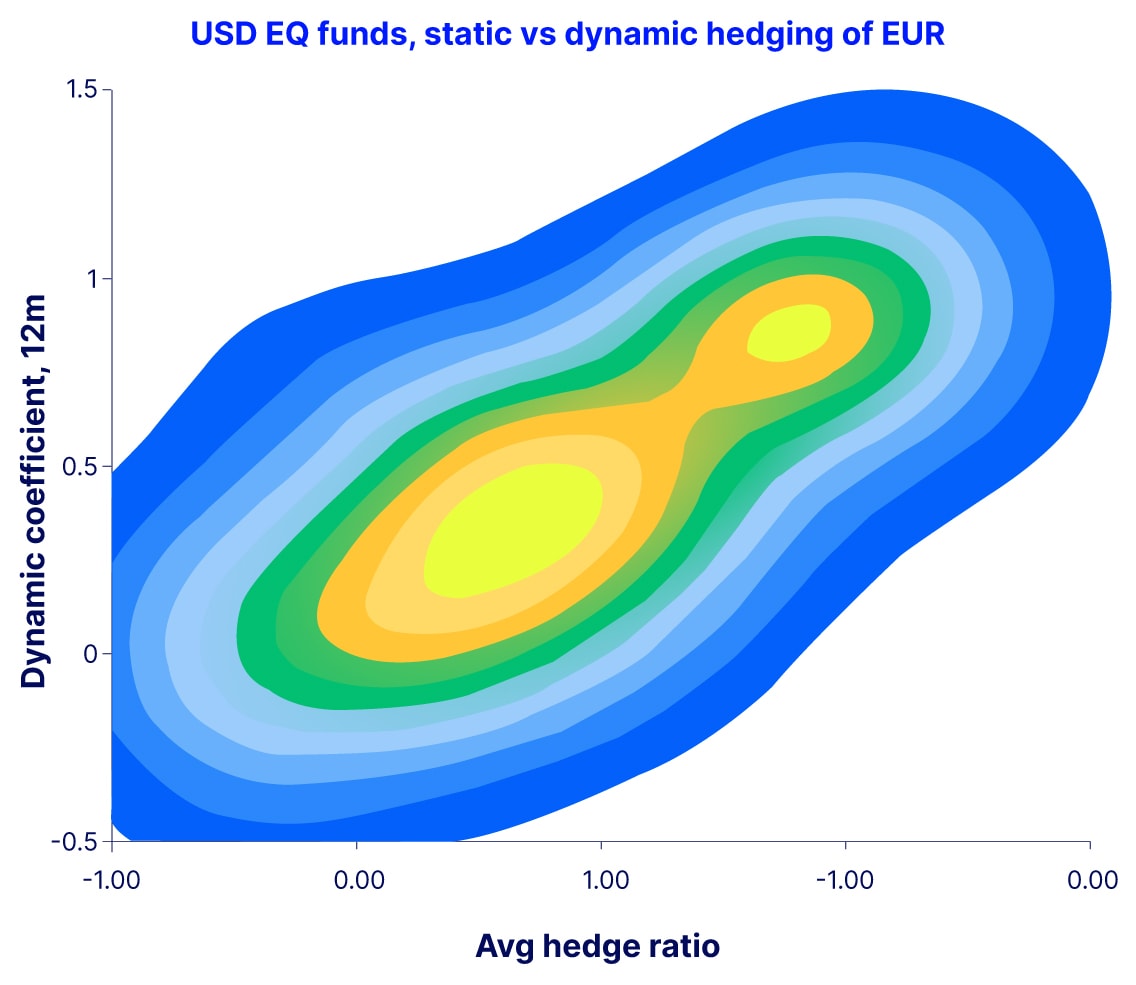

Currency risk is a key component of global investor returns, but different categories of investors approach these exposures differently. The hedge ratio measures how much an investor chooses to hedge their foreign currency exposure. For example, a foreign equity holding of JPY100 paired with a short foreign exchange (FX) forward position of JPY-50 implies a JPY hedge ratio of 50 percent. Using our proprietary custodial data, we have a uniquely precise view into how investors actually choose to hedge and how that varies over time, by asset class, and across different investor domiciles. We introduce a new quantity, the “dynamic hedge ratio,” to capture how investors adjust their hedge ratios and rebalance their currency risk over time.

We find that:

- Investors in the United States hedge less than investors in other domiciles

- Equity investors hedge less than fixed-income investors

- Investors tend to pick and stick to target hedge ratios

- Average hedge ratios evolve over time, driven in part by currency, equity and bond factors

- Even after accounting for other factors, investors hedge more post-Global Financial Crisis (GFC)

Our findings imply that all is not symmetric in the world of FX demand. If US and European investors each buy equivalent amounts of foreign assets, the Europeans will tend to hedge more and thus, impact currency demand less. The same applies to equity versus bond allocations: Shifting from foreign bonds to foreign equities, which are less hedged, may create net positive demand for the foreign currency as forward hedges are unwound. Finally, since investors stick to hedge ratios, local return shocks in foreign markets create currency demand as investors seek to rebalance their hedge ratios.