Insights

Implications of a pause to the SEC’s final climate disclosure rule

New questions have emerged for companies in scope of the SEC’s final rule and for global investors.

May 2024

Ciara Horigan

Head of Sustainability Public Policy, Regulatory

Anna Bernasek

Global Head of Thought Leadership

With mounting legal challenges to its final rule requiring large companies to provide enhanced climate-related disclosures, the US Securities and Exchange Commission (SEC) paused implementation pending judicial review in the US Court of Appeals for the Eighth Circuit. While we cannot predict what the court will decide, there could be implications of a pause for companies in scope of the SEC’s final rule as well as for investors that believe certain climate-related information is beneficial to investment decisions. And even if the SEC climate disclosure rule survives legal challenge, mandatory climate disclosure requirements in other jurisdictions – for example, the European Union – are more stringent and will apply to certain US parent companies.

Status quo

The SEC has made clear that it is not departing from its view that the final rule is consistent with applicable US laws and within its legal mandate to require disclosure of information that is important for investors’ decision-making and voting. As such, the SEC intends to “vigorously” defend the validity of the rulemaking in court and “looks forward to expeditious resolution of the litigation.”

The proposed rule, issued by the SEC on March 21, 2022, garnered huge attention from a wide range of stakeholders – as anticipated given its broad application to all domestic and foreign registrants (except for asset-backed issuers) – and resulted in over 20,000 public comments filed.

The sheer volume of stakeholder feedback certainly contributed to the delayed publication of a final rule and has allowed the SEC to substantially revise its proposals in order to address the criticism. The SEC’s pause, done at its own discretion, gives some breathing room to companies that may face additional costs and implementation burdens from the new rule, by not subjecting them to the requirement until it has been verified legally. In particular, the SEC dropped the proposal to require companies to disclose Scope 3 greenhouse gas (GHG) emissions. This had been a contentious aspect of the proposal given Scope 3 GHG emissions are much harder to measure, as they result from activities that a firm does not directly own or control, but may influence indirectly through its value chain.

What climate-related disclosures is the SEC mandating?

On March 6, 2024, the SEC adopted a final rule entitled “The Enhancement and Standardization of Climate-Related Disclosures for Investors,” requiring registrants to provide climate-related information in their SEC filings and annual reports, as a response to investor calls for more information on related risks that could affect the public companies they invest in.

The SEC’s disclosure requirements are broadly based upon the Taskforce on Climate-related Financial Disclosures (TCFD) recommendations on integrating climate risk into governance, business strategy, risk management, targets and metrics. Key disclosure requirements include:

- Material climate risks: Identify any material climate-related risks that could reasonably affect companies’ business strategy, financial results, operations or overall financial condition, in addition to actual and potential financial impacts of identified climate risks on the companies’ strategy, business model and economic outlook.

- Mitigation or adaption plans: If applicable, companies will need to disclose information about any actions to mitigate or adapt in view of material climate-related risks, including transition plans, scenario analysis or internal carbon prices.

- Climate risk management: Report any processes for identifying and assessing material climate-related risks and where they are being managed, as well as how such processes are integrated into a company’s overall risk management framework.

- Climate goals and targets: Information on any climate-related targets or goals that have materially affected or are reasonably likely to materially affect business, results of operations or financial condition. This also includes material expenditures and impacts on financial estimates and assumptions as a direct result of actions taken in pursuit of those targets or goals.

- Greenhouse gas (GHG) emission metrics: Large accelerated filers (LAFs) and accelerated filers (Afs) are required to disclose Scope 1 and/or Scope 2 GHG emissions where material. For each category of material GHG emissions, a registrant must disclose gross emissions (before considering any purchased or generated offsets) released during the fiscal year. Registrants must also separately disclose each constituent GHG that is material.

- Governance: Describe any board oversight of the assessment and management of climate-related risks, including dedicated board committee(s) delegated responsibility in this capacity.

Who does the rule apply to?

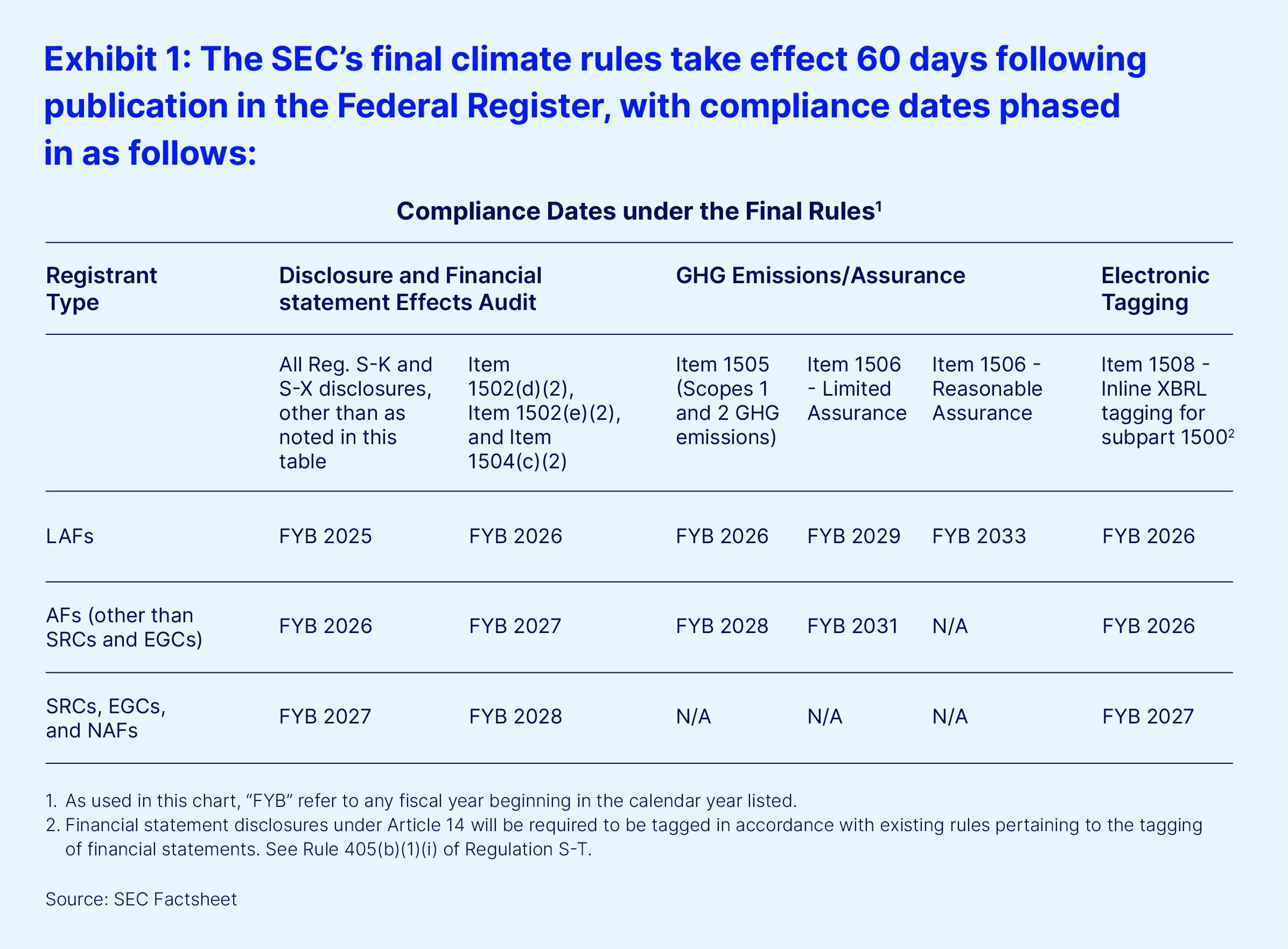

The final rules apply to all public companies in the US, with requirements phased in according to company size. That means smaller companies are provided some flexibility, as disclosure of certain metrics isn’t mandatory for them.

Additionally, the final rules require a registrant (including a foreign private issuer) to:

- File the climate-related disclosure in its registration statements and Exchange Act annual reports;

- Provide the Regulation S-K climate-related disclosures either in a separate section of its registration statement or annual report, or in another appropriate section of the filing (e.g., Risk Factors, Description of Business or Management’s Discussion and Analysis) or by incorporating reference from another SEC filing; and

- Electronically tag climate-related disclosures (eXtensible Business Reporting Language format).

What we don’t know

There are two key unknowns: the duration of the judicial review and its outcome. While there are multiple lawsuits that have been brought against the SEC’s climate rule and the federal appeals court is consolidating those to ensure an efficient process, it’s unclear when the legal proceedings will begin and how long they will last.

If the SEC loses, what will happen to the climate rule? Will the SEC be able to amend the rule? Or will it need to start from scratch and issue a new rule with public consultation?

If the SEC wins, will it decide to change any of the implementation timelines? Will it expect companies to have been working towards this since it was made final? (See Exhibit 1)

Implications of the pause

There has been a significant effort across the global regulatory community to enhance and standardize the way in which companies describe the carbon footprint of their business operations and their exposures to climate-related risks. And that is unlikely to change even if the SEC’s climate disclosure rule is overturned in court.

Mandatory climate disclosures by companies across all sectors, including banks, asset owners, asset managers and other financial market participants are likely to continue to be a prominent focus of regulatory agendas. Many national regulators have built off of globally accepted standards, such as the recommendations first issued by the TCFD in 2016. Further standardization is expected at the global level with the development of sustainability-related reporting by the International Sustainability Standards Board.

But there are considerations for public companies amid the ongoing legal challenge and implementation pause. For example:

- For large firms operating globally, mandatory climate-related disclosure requirements have already gone into effect in Europe and elsewhere. To what extent does this pause disrupt important implementation work already well underway?

- Small firms may face the burden of increased cost and effort to implement the SEC’s climate disclosure rules. Is there a case to wait until the courts decide?

- Does the climate rule pause mean the SEC will continue to withhold publication of its final (separate) rule regarding ESG disclosures for investment managers and financial advisers? This is important as the asset management industry considers enhanced and standardized company disclosures a prerequisite for compliance with investment fund disclosures in this area.