Insights

Who will buy the oncoming surge of Treasuries? And at what price?

Implications of shifting supply-demand dynamics of United States (US) Treasuries

August 2024

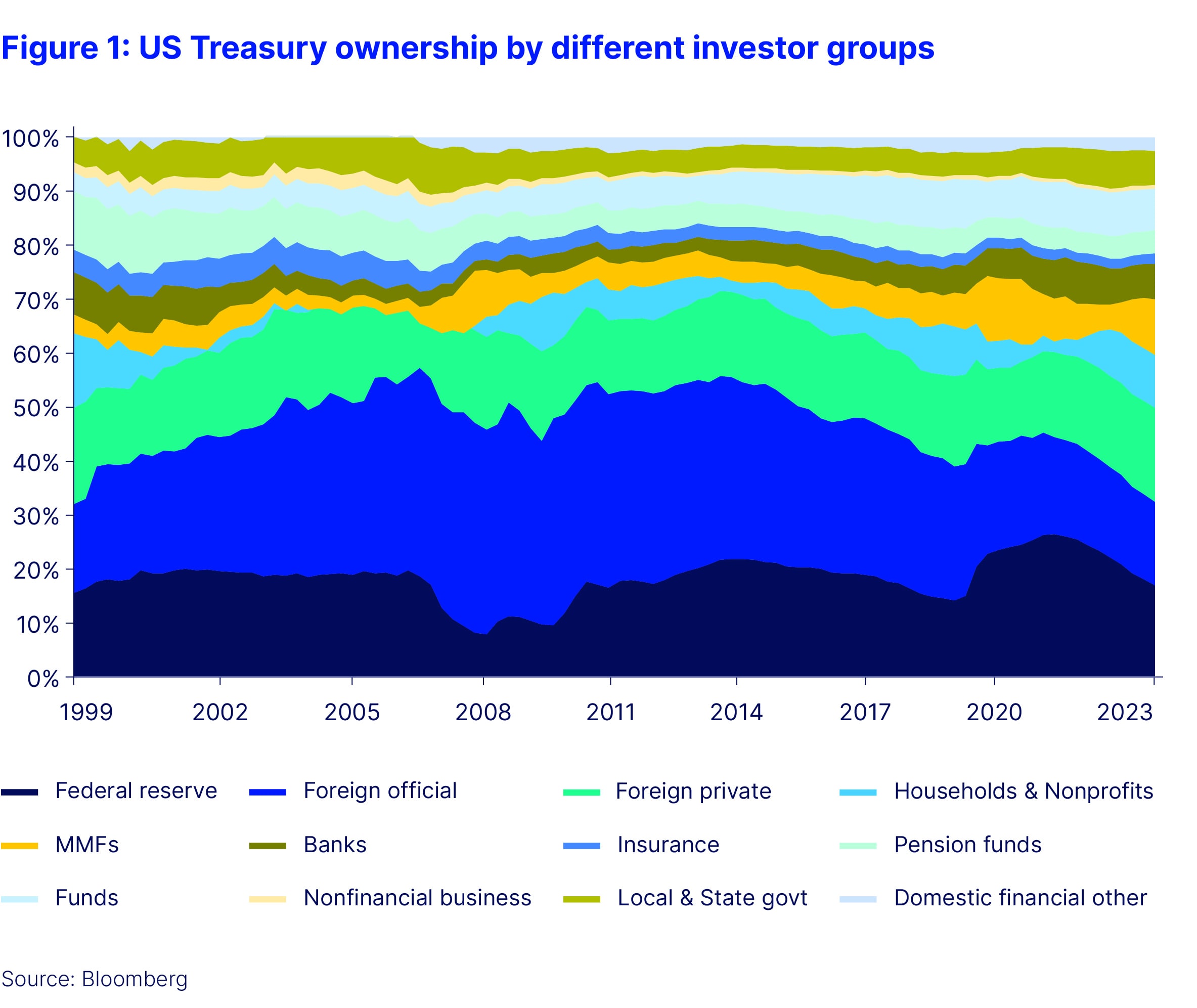

Growing US federal budget deficits and higher refinancing costs are bringing renewed attention to the US Treasury market. Over the next decade, an estimated US$2 trillion of net issuance is expected annually. This issuance will take place in a market environment quite different from that of the 2010s, where price-insensitive buyers, such as the US Federal Reserve (Fed) and foreign central banks, were the sources of increased demand. This landscape has shifted with the end of quantitative easing (QE) and reduced foreign reserve accumulation. By simple arithmetic, price-sensitive buyers, such as US households and corporates, are expected to account for a growing share of Treasury investors.

The shift in investor demand base (as per Fig. 1), together with the expected surge in Treasury supply, may result in rising yields. We believe these forces are likely to push yields higher, outweighing any increased demand for longer-dated fixed-income securities driven by demographic forces. Given these evolving supply-demand dynamics, key questions arise: How will the changing landscape impact the risk premia for US Treasury securities? Put differently, how much additional risk premium will likely be required to entice price-sensitive buyers to clear the additional anticipated supply entering the US Treasury market? And what broader market implications could these shifts have?

In this paper, we explore these questions using an intuitive model of portfolio choice by typical US Treasury market participants. Our approach involves:

- Examining the changing holding structure of US Treasuries across different investor groups

- Empirically analyzing the absorption capacity of various investor types and estimating their yield sensitivity to additional debt purchases

- Conducting a counterfactual analysis to assess the potential increase in the market-clearing yield due to supply growth

We find that price-sensitive participants will likely demand an additional 95 basis points (bps) of yield to absorb the increased issuance. A meaningful rise in Treasury yields has broader implications for credit, equities and other risk assets. This higher risk premium, equivalent to approximately one-and-a-half times recent yield volatility, could have a significant impact on fixed-income indices, such as the Barclays Aggregate, Investment Grade and High Yield bond indices, as well as the typical 60/40 policy portfolio. All of these indices are projected to experience significant losses ranging from 5 to 8 percent.

We believe that much of the expected increase in the risk premium should be attributed to term premia rather than expected short rates. Term premia represents compensation for a variety of risk factors surrounding rates, including inflation, monetary policy, policy uncertainty and economic growth. With the Fed Fund rates expected to ease following anticipated Fed cuts, our projections of risk premia can be attributed almost entirely to higher term premium. We see evidence for this in rate derivative markets — both the level of 5y5y as well as the predictive power of volatility metrics — that clearly reflect this need for higher risk premia arising from the changing supply-demand dynamics.

There are three broader considerations at play here, too. First, as price-sensitive buyers become more dominant in absorbing US Treasury supply, the market may experience increased volatility as well as higher yields. Unlike price-insensitive buyers that typically purchase US Treasuries for policy reasons rather than yield, price-sensitive buyers are more likely to respond to evolving market conditions and economic data, thereby increasing volatility in US Treasury prices. As volatility increases, investors will likely demand a higher term premium.

Second, increased sensitivity of US Treasuries to market swings and macroeconomic data may also challenge the traditional view of US Treasuries as safe-haven assets. As the market becomes dominated by price-sensitive buyers and their yield sensitivity grows, managing downturns becomes more challenging as the yield floor for Treasury absorption may rise. This increases the cost of hedging during downturns.

Lastly, from a monetary policy perspective, this shifting debt demand environment can potentially limit the effectiveness of the Fed’s policy. A marketplace influenced more by price-sensitive buyers could diminish the effectiveness of the central bank’s maneuvers of long-term interest rates through Treasury purchases, particularly during economic downturns where robust monetary intervention is crucial.

In sum, the unprecedented increase in US Treasury supply — and the resulting shift in risk premia — will materially affect asset allocation and market liquidity. Estimating the impact of this inflow in the US Treasury market is crucial, as risk-free rates underpin risk premia in global finance.