Insights

February 2025

2025 Global ETF Outlook: The expansion accelerates

What’s the next big thing for ETFs? Our experts share their predictions for the megatrends that are set to shape each major region throughout the year.

Frank Koudelka

Global Head of ETF Solutions

Jeff Sardinha

Head of ETF Solutions,

North America

Ken Shaw

Head of ETF Solutions,

EMEA

Ahmed Ibrahim

Head of ETF Solutions, APAC

Preface

Last year, when State Street’s ETF product team published their annual outlook report for the global industry, they predicted that ETFs would grow in all directions. Not only were they right about the big picture, but when it came to their more granular predictions for ETF expansion in individual markets — e.g., the number of new entrants, the size of flows into active funds, and the number of fund closures — they demonstrated 90 percent accuracy. That’s an impressive achievement in this complex space.

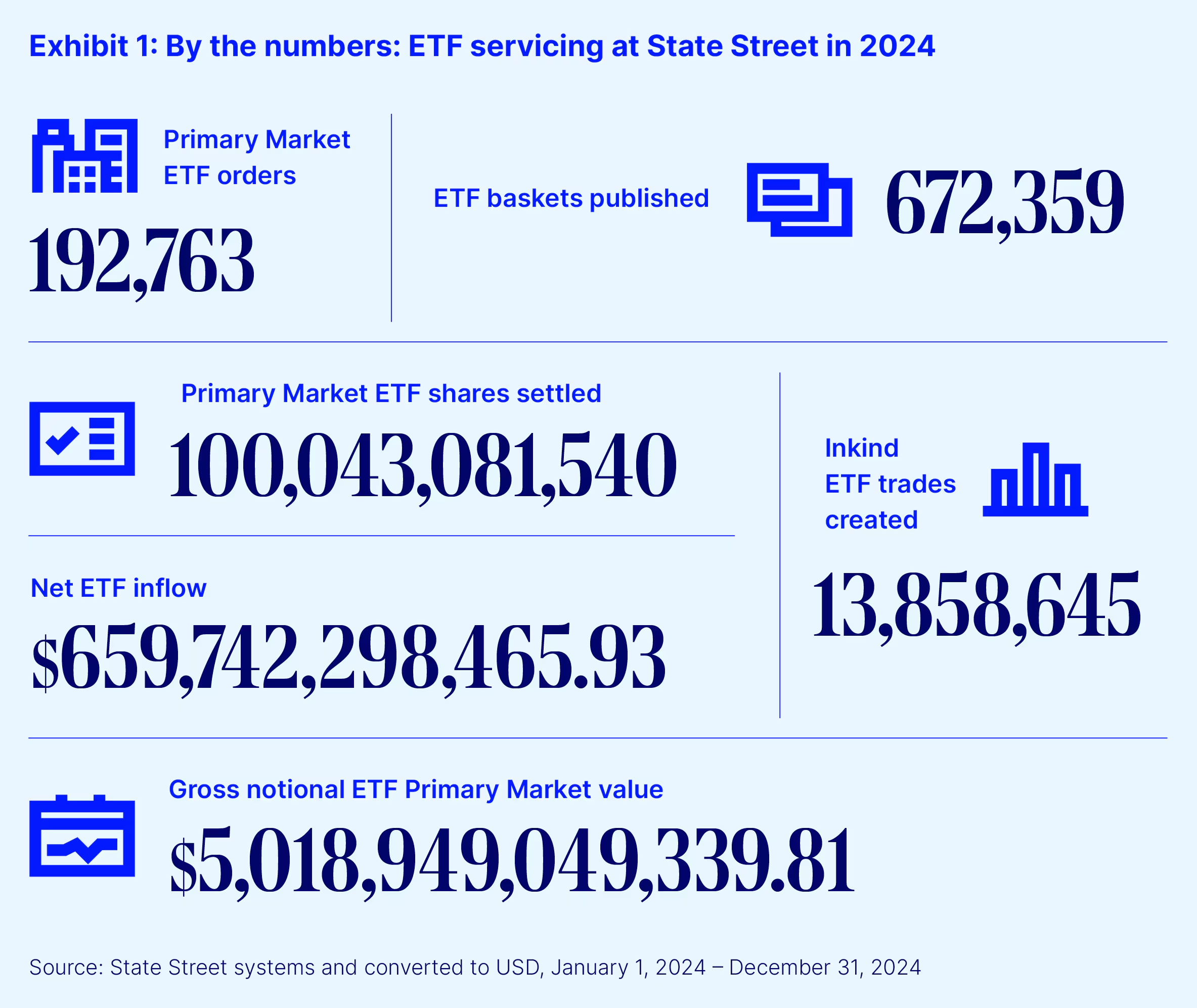

That track record will come as no surprise to those who know our ETF team. Led by Frank Koudelka, a veteran of the industry, the team’s reach is global with Jeff Sardinha in North America, Ken Shaw covering Europe, the Middle East and Africa, and Ahmed Ibrahim in Asia Pacific. As the number-one ETF servicer in the world,1 State Street applies our teams’ extensive expertise and deep market insights to provide clients with a distinct advantage (see Exhibit 1, “By the numbers: ETF servicing at State Street in 2024,” in Chapter 2: Megatrends by region).

This unique perspective underpins the predictions you’ll find in the pages of our 2025 Outlook. The ETF team lays out their predictions for the megatrends that are set to shape each major region throughout the year, then they dig deeper to provide granular predictions, some of which may surprise you. For example, despite growing expectations that the United States Securities and Exchange Commission (SEC) will approve applications to add ETF share classes to existing mutual funds or allow the conversion of mutual funds to ETFs, State Street’s ETF team expects those products to launch in early 2026 rather than in 2025. But that’s only one of the many insights you’ll gather from this report.

In addition, you’ll find the views of other industry leaders about what’s in store for 2025 in Chapter 1: Industry perspectives. Here you’ll discover a selection of client views from big picture trends to the outlook for specific markets including Taiwan and Australia.

Lastly, don’t forget to check in with us mid-year. At that point, the ETF team takes a hard look at their predictions and provides an update as to where they’re on track and where they will adjust. We believe this mid-year review is a helpful tool to identify new industry developments as they arise.

Anna Bernasek, Head of Insights

1. Industry perspectives

In 2024, ETFs grew across all measures: from every corner of the globe, every asset class, and with every generation of investors. Globally, a record US$1.9 trillion poured into ETFs last year, with total assets in ETFs now standing at US$14.7 trillion.2 Every major ETF market saw inflows of between 20 and 30 percent.3 Equity, fixed income, active, passive, commodities, currency and digital assets all enjoyed inflows in 2024. And industry surveys point to investors across demographics increasing their share of investable assets in ETFs over the next five years.4

Investors have voted with their feet, and asset managers have listened, launching ETFs to support mounting customer demands. The market has witnessed multiple new major managers enter the ETF space (we look more closely at that growth later in the report). We have also seen broker/dealer platforms increase the number of active ETFs they are willing to use, even with the recent legal actions and questions related to the US Securities and Exchange Commission’s Regulation Best Interest.5 All of this is good news for ETFs and the investors using them. We are seeing more product choice from a larger menu of professional fund managers.

What does all this mean for ETFs in 2025? In the following sections of this report, we outline the megatrends we have identified for each region and make specific predictions about the industry in 2025. But first, here’s a selection of what our clients told us they’re expecting in 2025:

The big picture

Noel Archard, Global Head of ETFs and Portfolio Solutions, AllianceBernstein

“I see several trends playing out for the ETF market in 2025:

- The first is growth, not just in the US, but across all super-regions. Based on current growth rates, we see the US Active ETF market surpassing US$3 trillion in the next three years representing over US$2 trillion of money in motion. While it might seem challenging to top the record-breaking flows we saw in 2024, ETFs thrive when there are expectations of change, and we are continuing to see ETFs used to make directional portfolio shifts, both strategic and tactical.

- Active ETFs will be another growth engine for the industry, as more investors are looking at ways to add active strategies back into their allocations, given the flexibility afforded by packaging the strategies into ETFs. This is leading to the dollars invested in active ETFs moving beyond the initial fixed-income products, and expanding into equity, defined outcome, enhanced income and alternative exposures. Investors are seeking diversification (given high levels of concentration in certain benchmarks), while also increasing their allocation to opportunistic equity investments to balance the risk profile of their positions and gain access to other opportunities. We spend a lot of time discussing with clients the megatrends driving future growth like artificial intelligence (AI), medical innovation and future energy.

- Beyond the expansion of asset classes, we are also seeing more regulators and ecosystems around the globe adapting their regulations to fold active ETFs into the mix, bringing new markets and clients to the table.

The final catalyst is the ongoing adoption of model portfolios, where ETFs (both active and passive) remain one of the most efficient building blocks for strategists to express their portfolio views.”

A closer look at the dynamics of growth

Eduardo Repetto, Chief Investment Officer, Avantis Investors by American Century Investments

“Increasing confidence in the ETF structure globally is pushing ETF usage to new highs at the expense of other, more limited structures. The trend line in mutual fund versus ETF flows, for example, is reminiscent of the decline in pay phone/landline usage as cellular technology was adopted.

Investors are becoming more aware of the benefits of ETFs versus mutual funds or separately managed accounts (SMAs). The more they learn, the stronger their conviction to use the ETF structure instead of others. Unlike mutual funds, ETFs provide strong protections from the actions of other shareholders. ETFs also overcome the limitations of SMAs by offering better long-term tax efficiencies and the ability to invest in foreign markets. There are still a few punctual cases for SMAs and some operational barriers to converting to ETFs in some investor channels, i.e., retirement, that may delay change, but history suggests these barriers can only persist for so long. It is also worth noticing that standalone ETFs have benefits not seen in other structures, not even hybrid structures.

Passive ETFs have been around and growing for a long time. In many markets, the elimination of the artificial barriers that produced an unsatisfied demand for active ETFs will continue to drive robust growth. For those markets that have been slower to evolve, we believe the noticeable benefits achieved in markets that have embraced the ETF structure will drive investors, service providers and regulators to think differently.

Predicting the growth of ETFs globally is not really a forecasting exercise, it is a fait accompli.”

Greg Friedman, Head of ETF Management and Strategy, Fidelity Investments

“We’ve seen tremendous growth in ETFs, and the industry has been dynamic in listening to client demand. As offerings have evolved over the years with a focus on passive, factor and smart beta products, active ETFs have now come to the forefront in a really meaningful way. It’s one of the biggest inflection points I’ve seen in the ETF space. This is an incredibly exciting time of growth, development and innovation, and our research and client feedback supports this shift. It’s still early days, but if you look at how the mutual fund industry evolved and the size of the active component within that, you can see how that growth is shaping out in ETFs as well. I see the wave of active ETFs as a whole having continued potential in a highly competitive space in the years to come, and at Fidelity we’re excited to be a leader in the space.”

And don’t forget innovation

James Harrison, Head of Capital Markets, MFS

“Two words. Growth and innovation. That is what will define 2025. Growth in active ETFs will continue to take off as more investors seek flexible, tax-efficient options that can adapt to changing markets. One big development to watch is the potential ETF share class exemption, which could open the door for mutual funds to offer ETF share classes — making ETFs even more accessible to a wider audience.

On top of that, we’ll likely see more innovative products, like ETFs tied to alternative assets or niche strategies, giving investors even more options to diversify and customize their portfolios. So, it’s an exciting time and at the end of the day, it’s going to be about expanding investor choice, both in the strategies available and the wrappers that deliver them.”

Robert Mitchnick, Head of Digital Assets, BlackRock

“In 2024, the newly launched spot Bitcoin ETPs saw unprecedented adoption, helping to bridge the gap to traditional finance. This sparked a surge of interest from end investors, wealth advisory and institutional capital, causing the novel spot Bitcoin ETP category in the US to grow to >US$100B in AUM.

With 2025 underway, public policy dynamics are front and center, including how the new administration and Congress in the US might address their stated ambitions for growth and innovation in the space. An increasing focus on US debt and deficit challenges has the potential to serve as a catalyst for Bitcoin adoption, while the possibility of higher-for-longer interest rates represent a potential price headwind.

Institutional investors are still relatively early in their progression of considering allocations to Bitcoin, and at what size. Meanwhile, we are closely watching the dynamic playing out across the global landscape of various political jurisdictions considering the creation of strategic Bitcoin reserves, which has the potential for domino-like effects.”

Matthew Sigel, Head of Digital Assets Research, VanEck

“The integration of digital assets into mainstream finance will define the ETF landscape in 2025. As more crypto companies go public and traditional firms increasingly add cryptocurrencies to their balance sheets, we anticipate a wave of new ETFs designed to capture the unique growth and risk profiles of digital assets. The ongoing limited sell-side coverage of this sector provides a fertile ground for innovation, leading to products that offer exposure to both core digital asset growth and alpha opportunities.

This year, digital assets and the associated stocks are poised to become more accessible and investable through ETFs, driving financial market innovation and expanding investor participation.”

Anna Paglia, Chief Business Officer, State Street Global Advisors

“Private assets are one of the fastest growing sectors of the financial industry. Over the last decade, assets in private markets have nearly tripled, as large institutional investors have become attracted to the potential for higher yields and greater diversification, and their demonstrated resilience during times of volatility. Until now, private assets have mainly been open to large institutions and ultra-high net worth investors.

Looking ahead, we see a greater focus on democratizing access to private asset exposures and alternative investment strategies through ETFs and other investment products, making them more accessible to a wider swath of investors who seek similar benefits.”

Oran D’Arcy, Head of Listings APAC, CBOE Australia

“We expect innovation and growth in the ETF space to accelerate further in 2025, particularly in options-driven ETFs, which have rapidly gained traction in the US. With assets under management already surpassing US$170 billion, this momentum shows no signs of slowing. Notably, half of the 500 options-driven ETFs available today were launched in the past two years, indicating strong investor demand. Given this trajectory, we anticipate broader global adoption of options-driven ETFs and an increase in new product launches.”

The continued rise of Active ETFs

Scott Davis, Head of ETFs, Capital Group

"The market and investors clearly understand the value active ETFs can bring to a portfolio – particularly those designed as core building block solutions. We expect the momentum in active ETFs to continue in 2025, supported by the growing use of active ETFs in model portfolios which we think will be an increasingly important driver of active ETF flows.”

Scott Kilgallen, Managing Director, Head of Intermediary Distribution, Neuberger Berman

"We see tremendous potential in high-quality active fixed income management, particularly as higher terminal rates become a more persistent feature of the market. This environment is leading to increased investor focus on fixed income and the variety of strategies available in the space. The adoption of truly active fixed-income management within the ETF wrapper, in particular, is still in its early stages. These strategies can span specific sectors and market segments, and even cross borders, offering a broader and more global perspective.

Additionally, ongoing advancements in fixed-income market structure are making the ETF wrapper increasingly efficient for investors. It’s surprising how often we encounter investors who are unaware that their fixed-income ETF options now go beyond traditional, compartmentalized index products. This evolution highlights the exciting opportunities available in active fixed-income management today.”

Greg Hall, Head of US Global Wealth Management, PIMCO

“Fixed income has been the greatest beneficiary of the growth in active ETFs. Over the past two years, the total size of the active fixed-income ETF market has more than doubled in the US, ending 2024 at US$282 billion in assets – up from US$140 billion at the start of 2023. We expect that trend to continue, particularly as active fixed-income ETFs may offer investors compelling diversification and resiliency to their portfolios. Multisector and core-plus bond ETF strategies are two areas that currently offer investors attractive starting yields, both relative to the pre-COVID era and to historically stretched equity valuations, and can serve as a hedge against slower economic growth.”

Spotlight on ETF growth in APAC

Eddie Cheng, Chief Investment Officer, Cathay Securities Investment Trust Co., Ltd.

“The year 2024 has been a fruitful one for Taiwan’s ETF market, with its scale surpassing the high growth of 2023, reaching an approximate growth rate of 65 percent. Looking ahead, as stock market risks increase, US Treasury yields remain relatively high, and regulatory measures tighten, the ETF market inflows in 2025 may not sustain a rapid growth rate of over 30 percent. However, it is estimated that growth may still range between 20 and 30 percent. Additionally, new product development will serve as another growth driver for Taiwan’s ETF market, including active ETFs, multi-asset ETFs, and US Treasury 20+ Years ETFs listed in the USD counter.”

Dr. Julian Liu, Chairman, Yuanta Securities Investment Trust Co. Ltd./Chairman, Securities Investment Trust & Consulting Association of the R.O.C. (“SITCA”)

“Taiwan's ETF AUM exceed NT$6.4 trillion in 2024, with an annual growth rate of 65 percent, ranking it the third-largest market in Asia. Bond ETFs are the largest asset class of Taiwan's ETFs, reaching NT$3.09 trillion by the end of 2024, accounting for 48 percent. The annual AUM growth of NT$1.04 trillion, with an annual growth of 50 percent, making it the largest bond ETF market in Asia. By the end of 2024, the number of ETF beneficiaries in Taiwan reached 14.11 million, an increase of 5.42 million throughout the year.

The single-year increase set a record high, with an increase of 62 percent. The Financial Supervisory Commission of Taiwan has proposed a policy to build Taiwan into an Asian asset management center. The Financial Supervisory Commission announced the opening of active ETFs and passive multi-asset ETFs. This opening will enable the integration of previous zero-sum game between active and passive fund products. We are expecting that more foreign investment trust companies will join Taiwan's ETF market in 2025, and there will be an opportunity to directly introduce overseas ETF players to issue local domiciled active ETFs in Taiwan. In addition, since passive multi-asset ETFs still need to track indexes, new policy should bring new business opportunities to domestic and foreign index companies.

In the future, the ETF regular saving plans (RSPs) and portfolio management functions on broker applications of trading software (APPs), combined with innovative AI technologies, will be able to provide Taiwanese investors with intelligent investment solutions, and continue to drive the growth of the Taiwan ETF market.”

Jamie Hannah, Deputy Head Investments and Capital Markets, VanEck, Australia

The Australian ETF industry experienced record net flows last year, and we anticipate this record will be surpassed in 2025, exceeding AU$300 billion by year end. 2025 is shaping up to be a defining moment in the industry's evolution. Wealth managers are increasingly adopting ETFs as the preferred building blocks for portfolio construction. The ability to achieve targeted investment outcomes and access systematic, research-backed strategies with relatively low fees and ease of accessibility on exchange is driving this momentum.

The Australian investor profile is also changing. Australians have historically demonstrated a home bias in their portfolios, despite the domestic market representing only a small portion of opportunities available in the global investment universe. Net flows to international equity ETFs in 2024 increased by 368 percent year-on-year to a record AU$15 billion, more than doubling the flows to Australian equity ETFs.”

Andrew Campion, General Manager Investments Products, Australian Securities Exchange (ASX)

“In 2025, the ETF market is on track to surpass AU$300 billion (includes both CHESS and non-CHESS FUM). Active ETFs to represent over 50 percent of new admissions in the market. The average daily trading value for ETFs in the Australian market to surpass AU$600 million.”

2. Megatrends by region

As the world’s number-one ETF service provider, we have an in-depth understanding of the market that our competitors simply can’t match. The proof points demonstrating this servicing expertise further underscore our leadership. Last year, for instance, we settled over one hundred billion ETF shares (Exhibit 1). This unique perspective informs our analysis of megatrends by region in 2025.

North America

Our top trends for North America in 2025 include the continued growth of active ETF adoption, the increasing use of derivatives, the further expansion of digital assets and the Trump Administration’s impact on ETF regulations.

Active ETF adoption continues to grow

In North America in 2024, 934 new ETFs came to market and 78 percent of those were in active strategies.6 In some ways this was not a surprise given we’re now five years beyond the passage of ETF Rule 6c-11, which created a more efficient path to launch active ETFs and leveled the playing field regarding the use of custom baskets.

We saw a number of major active managers enter the market, including Allspring, Capital Group (expansion to Canada), Harris Oakmark and MFS (credited with launching the first mutual fund 100 years ago). Active inflows reached a record of US$336.6 billion, more than double the previous North American record, and pushed AUM over the US$1 trillion mark. While actively managed ETFs encompass 9 percent of total ETF AUM, they claim 27 percent of the flows.7

Data from 2024 points to the continued acceleration of the active ETF wrapper. This is where the white space is for new entrants to differentiate themselves within a competitive industry. Active fixed income was a bright spot in 2024, more than tripling 2023 inflows, and we see that trend continuing in 2025. We expect active fixed-income flows to increase again while passive fixed-income flows could stall or even decrease.

Increased use of derivatives in ETFs

Buffer ETFs were among the most notable product strategies in 2024 due to the number of products launched and the innovations active managers are applying to the structure (Also known as defined-outcome ETFs, buffer ETFs use options contracts to offer a pre-defined range of outcomes over a set period of time). Calamos Investments has gone as far as adding 100 percent protection products. Investors typically use these products to protect against bear markets or for those later in their investing lifecycle seeking to protect principal. We are also seeing younger investors planning to take advantage of protection products, with 24 percent planning to invest in these structures in the next five years.8

We envision these products expanding downside protection to other asset classes as well. We also see a use case for these strategies to replace a portion of the allocation to traditional passive fixed income (specifically 100 percent protection products) based on a similar risk profile with more upside potential at a reasonable price point (69-79 basis point fee).

Derivative income ETFs such as the JP Morgan Equity Premium Income ETF are being duplicated by many providers. We expect to see a continued proliferation of these products, with flows diversifying across more issuers during 2025.

Investors in Canada have multiple choices to invest in high-yield savings account ETFs (HISA) or money market ETFs with products available from multiple sponsors. These, combined with covered call equity income ETFs, took in about US$10 billion of the Canadian market’s US$64 billion in 2024 inflows.9 The attractiveness of the HISA funds experienced a setback in 2024 as the Office of the Superintendent of Financial Institutions (OSFI) reclassified the assets in HISA ETFs, mitigating the advantage these products had on yields.10

Looking forward, money market and ultra short-term bond ETFs could be the beneficiaries of the reclassification requirement. Additionally, future interest rate cuts will reduce their attractiveness (the Bank of Canada has had six straight interest rate cuts through January 2025).

Further expansion of digital assets

The US market caught up with Canada with the launch of spot Bitcoin and Ethereum ETFs. The Bitcoin bonanza occurred early in 2024 when the SEC approved the first 10 ETFs (coming off the heels of the US Court of Appeals granting Grayscale petition for review; essentially vacating the SEC’s prior rejection of Grayscale’s filing for a spot Bitcoin). What ensued was rather unexpected by most industry experts, with 11 of the top 20 new ETF launches tied to spot Bitcoin or spot Ethereum.11

In 2024, digital asset ETFs had US$64 billion of inflows (not including Grayscale’s converted assets). A new asset class was born and ended the year with US$118 billion in assets.12 To give this context, US actively managed ETFs did not eclipse US$100 billion until 11 years after the first launch. iShares Bitcoin Trust led the way, ending the year at US$50 billion. Throughout the year, additional products launched including spot Ethereum, digital strategies that used synthetic exposure, and even products tied to companies participating in the expansion of digital technologies.

2025 will bring spot multi-coin ETFs expanding beyond Bitcoin and Ethereum. We also see in-kind trading of these products on the horizon allowing even more efficiency. The ETF allowed for an asset that has lived on digital rails to be placed inside an asset that lives on traditional financial rails. Like every other historic moment in ETFs, we began small, took some baby steps, and then a leap, only in this case we skipped the baby steps.

ETF regulatory impacts

We have mentioned a few areas where new regulations have already benefited ETFs. There are two more that we expect will increase debate, but ultimately move in the direction toward ultimate approval.

The first is ETF share class. At the time of writing there have been 45 filings to add an ETF share class to an actively managed mutual fund (and even two filings adding a mutual fund class to a traditional ETF). Mutual funds will have the potential to more efficiently manage capital gains, while ETFs will have the potential for a more efficient portfolio repositioning. The addition of scale and historical track record will help ETFs quickly get over the hurdles that exist today for platform access of new entrants.

Like all innovations, there is industry work to be done to find a solution for the ETF share class structure, specifically the “exchange privilege.” The exchange privilege is an important feature that provides mutual fund shareholders the flexibility to execute tax-free exchanges to the ETF share class. This has occurred over 100 times in the past few years via the mutual fund-to-ETF conversion process. It involves the mutual fund transfer agent, the ETF transfer agent and the shareholder’s broker/dealer. Currently, this is a one-off event done at scale. But for ETF share class exchanges it could be a daily event. This would require industry automation to provide a scalable process for industry participants and a positive client experience.

The second is for private markets ETFs. Real private market access via the ETF wrapper won a number of news cycles and was a common topic on industry panels during the second half of 2024. The ETF wrapper has the potential to add liquidity to an asset class that has historically been out of reach for most retail investors: private credit. State Street Global Advisors’ filing for the SPDR SSGA Apollo IG Public and Private Credit ETF got the industry talking, planning and solving.13 The interesting part of the filing (and other subsequent filings) was the portion of the fund set aside for actual investment in private credit. There is work to be done both operationally and from a regulatory perspective, including liquidity rules, valuation policies for a daily net asset value (NAV) fund holding a position that does not typically price daily, transparency expectations and market making impacts. This is one we are keeping a keen eye on throughout 2025.

Europe

Our top trends for Europe include record growth of the overall market, the acceleration of actively managed ETFs, the move toward unlisted/listed share classes, the ongoing deceleration of ESG, and the increased adoption by retail investors.

Record growth expected

European ETF market flows had decelerated since the explosive record-setting growth experienced after the COVID lockdowns ended in 2021. But in 2024, ETFs roared back to life and established a new highwater mark with inflows eclipsing US$270 billion.14 This was close to 40 percent more than the previous record. ETFs brought in flows across all asset classes (equity, fixed income, cryptocurrency) and strategies (active, ESG, leveraged/inverse, passive, smart beta).

We believe this growth will continue as the market expands beyond institutional investors and retail adoption accelerates. Additionally, the market fragmentation of 25 jurisdictions and 29 exchanges is in the process of modernization with the advent of a consolidated tape.15 Finally, we expect to see an expansion of local and global managers entering the European ETF marketplace, offering more choice and innovation to the market.

Increasing percentage of active ETFs

Europe has seen the same ramp-up of active assets under management and flows as the US market experienced, beginning in 2019. In 2024, Europe saw a large uptick in raw inflows (from US$7 billion to US$20 billion), products (from 103 to 178) and providers (28 to 35). The most profound statistic was 2024 flows making up 74 percent of the previous year’s assets under management.16

We expect this trend to continue with more issuers and products entering the market. This will include a combination of standalone strategies and the expansion of unlisted funds launching a listed share class. Europe allows for this structure today and based on our conversations with clients, there is significant interest in leveraging it. An additional tailwind entering 2025 is the decision by Luxembourg’s Commission de Surveillance du Secteur Financier (CSSF) to exempt active ETFs from subscription tax and allow delayed portfolio disclosure.17 We expect other jurisdictions to follow suit.

Retail adoption ramps up

Although institutional investors make up a significant majority of the European market, retail investors are becoming a force. ETF Savings Plans increased by over 40 percent in the last year from 7.7 million to 10.8 million.18 Adoption of ETFs has been broad across the Continent with Belgian retail investors experiencing a 40 percent increase from 40,000 to 56,000, France (up 72 percent) saw an increase from 296,000 to 509,000, with adoption in Germany rising 25 percent from 2.8 million to 3.5 million.19 Many of these investors have savings plans with multiple digital platforms, neobrokers and robo advisors.

We expect this trend not only to continue, but to accelerate. Retail investors using ETFs are typically younger than those investing in other investment vehicles, in their prime earnings (and savings) years. As a result, not only will the number of investors continue to rise, but the amount of ETF assets held will also rise.

Asia Pacific

While ETFs enjoyed strong growth globally, the Asia-Pacific region (encompassing 16 countries offering ETFs) saw explosive growth of 47 percent (Exhibit 2).20 Even more astounding is the fact that 45 percent of that growth was from inflows and only 2 percent from market appreciation. Growth was broad and wide across all asset classes (equity, fixed income, commodity, cryptocurrency) and strategies (active, passive, smart beta, leveraged/inverse). The reasons for the growth vary by country and we’ll take a closer look at the five largest markets below.

We expect strong inflows to persist with expanding investor interest. We also expect actively managed ETFs to rebound as large, global issuers continue to enter the market and focus more on distribution.

Australia

The big story for Australia is the wide adoption of ETFs across channels, leading to growth of 26 percent last year and close to 30 percent CAGR during the last 10 years.21 Approximately 2 million of Australia’s 10.7 million investors hold ETFs in their portfolio.22 An increasing percentage of high-net worth individuals (HNWIs) are investing in ETFs via self-managed superannuation funds (SMSFs), with 43 percent of SMSFs using ETFs.23

Survey data shows ETF investors are younger, use the products for long-term savings and plan to increase allocations. Passive ETFs enjoyed strong inflows, while active ETFs were in outflows (outside of conversions to the dual registry or share class structure).24 And outside of the retail and SMSF markets, advisors are planning to increase allocations to ETFs by more than 33 percent during the next year.25

We see the growth in the ETF market continuing as the wrapper expands adoption across all investment sectors. We also see active ETFs getting a second wind, with flows increasing as more global managers enter the market with their best strategies. This will not put a damper on passive ETFs, which will see the lion’s share of flows and continue to cannibalize the managed fund market.

China

The China ETF market experienced explosive 75 percent year-on-year growth with over 60 percent of that coming from net inflows.26 The three big themes for 2024 were ETF buying by the state (national team, sovereign fund), expansion of ETF Connect and fund fee reform. It’s hard to pinpoint exactly how much of the record US$179 billion inflow was related to purchases related to the state, but it was substantial as the government attempted to stabilize its equity markets. Related to ETF Connect, the scheme expanded to Saudi Arabia27 and Singapore28 following the successful links to Hong Kong and Japan in past years.27 The final significant theme was the expansion of the ongoing fund fee reform to the ETF market. Late in the year, the largest ETF firms coordinated 70 percent fee reductions after the China Securities Regulatory Commission (CSRC) signaled the need to advance the reforms.

We see the state fund purchases continuing this year, the government signaled as much, requiring fund firms to increase holdings of local equities by 10 percent for the next three years. Purchasing ETFs will be an efficient way to do so. We also see a continued expansion of the ETF Connect program, with both Brazil and the United Kingdom (UK) in discussions to examine closer ties.28

Japan

While still holding onto the crown of the largest market in the region, Japan has seen that position erode since the Bank of Japan stopped ETF purchases in 2023. Even so, the market rebounded with over US$10 billion in net inflows. The major initiative providing tailwinds was the reforms to Japan’s Nippon Individual Savings Account (NISA). The changes include making the tax-free holding period indefinite, and increasing the annual investment limit and the tax-free holding limit.29 Japanese households have approximately US$15 trillion in assets with approximately 50 percent of it in cash equivalents.30 The goal of the NISA program is to increase savings in long-term investment vehicles such as ETFs. As the BOJ contemplates unwinding its balance sheet of the ETF purchases accumulated in the previous decade, incentivizing retail ownership is an area of exploration.

We believe that the ETF market will see increasing retail participation as issuers educate investors on the benefits of using this investment vehicle in NISA accounts. Secondarily, we expect more global managers will launch or cross-list ETFs into the Japan market based on this expanding investor base. And finally, we see more traction for active ETFs as asset managers leverage the efficiency of the investment wrapper to younger and more digitally savvy investors.

South Korea

Last year’s impressive ETF growth of 24 percent in the Korean market was only part of the story. The benchmark KOSPI index fell 10 percent and Korea Won dropped 12.5 percent as political turbulence rattled markets. Conversely, investors piled a record US$61 billion into local ETFs, a 58 percent increase from the previous year’s assets under management level.31 Key themes included record-setting growth, continued attractiveness of active ETFs and the prevalence of retail investors. As far as active, the Korean ETF market has the highest percentage of active ETFs globally (31 percent) and 2024 flows were 33 percent of the total. This is actually down from the previous year when active made up over 80 percent of total flows. The big shift in 2024 was flows into passive ETFs (with exposure to the broad local and US markets) making up approximately 15 percent of the total. Most of these flows occurred in December as investors flocked to these products during the previously mentioned volatility. Aside from active ETFs, retail investors are using leveraged/inverse ETFs tactically at the highest rate globally (9 percent of AUM). The other key theme has been the use of high yield/high dividend ETFs, including those tied to CDs, money markets and US T-Bills.

We see active ETFs continuing to be a significant component of local market growth. Investors have been interested in thematic ETFs that can capture outsized returns and global exposure. Passive products will provide diversification and core holding coverage, but active managers can home in on themes, and nimbly and dynamically rebalance portfolios. Additionally, the expanding use of active ETFs will continue to erode investment trust market share. In the last two years, ETFs have increased from 9.5 percent to 15.5 percent of the mutual fund market. We believe this will continue based on ETFs’ lower overall fees and easy adoption on digital platforms.

Taiwan

Outside of China, Taiwan is the fastest growing ETF market globally. ETF assets grew 54 percent last year and 39 percent over the past 10 years. The record US$63 billion of inflows was the second highest in the region.32 The market is super-charged by retail investors: Over 10 million of the 13 million investors on the Taiwan and Taipei Exchanges are now ETF shareholders.33 Compare this with the five million ETF investors a year earlier and you can see why growth in this market can be called “explosive.” Investors have been heavily weighted to high-yield investments (both high-dividend and US fixed income). The ETF market is swallowing the investment trust fund market with ETFs representing 65 percent of the market compared to 47 percent two years earlier. This has resulted in the Financial Supervisory Commission (FSC) approving active ETFs, providing local and global asset managers with a new avenue to participate in the adoption and growth of ETFs.34

We believe ETF growth will continue, as a growing percentage of the total investing public leverages the investment vehicle for wealth accumulation and income generation. We also believe the approval of active ETFs will have positive implications for managers that have seen their market share reduced at the expense of passive ETFs. Local investors enjoy the digital experience of ETFs and will give active managers a second look once they repackage their strategies within the preferred investment wrapper.

3. Market predictions for 2025

In this section, we go further than outlining megatrends by region. Here we offer detailed predictions by market and revisit them as the year proceeds to understand emerging market developments.

North America predictions

Digital assets were the story for a good portion of 2024 and we believe it will also be a story in 2025 with expansion of the asset class, additional growth and increased market participation.

We expect:

- Spot crypto products will expand to cover the top 10 coins based on market cap.

- Crypto ETFs will expand to multi-coin products well beyond Bitcoin and Ethereum.

- Digital asset ETF AUM will grow larger than precious metals ETF AUM by the end of 2025.

- Additional ecosystem members will gain comfort with trading digital asset products, and combined with regulatory easing, will pave the way for the approval of in-kind capabilities for digital assets.

ETF share classes will be the regulatory approval race that was the Digital asset bonanza of 2023/2024. At the time of writing, there are over 45 current filings to launch an ETF share class of existing mutual funds.

We expect:

- ETF share classes will not launch in 2025. We expect first products in the first half of 2026. This is not due to lack of desire. Latency with administration change and planning regulatory priorities will push this just over the line into 2026 (We hope we’re wrong!).

- ETF share classes will receive a similar blanket approval as digital assets received for all filers that stay aligned with regulator comments/requirements, instead of individual approvals.

Active management made massive inroads in 2024 collecting 26.7 percent of all net flows in the US, up from 23 percent in 2023. We do not expect that to slow.

We expect:

- Active ETF in the US will collect over 30 percent of all inflows in the US and eclipse total AUM of US$1 trillion by the end of the first quarter.

- Three ETF providers will eclipse US$200 billion in AUM.

- Three new top 50 active managers will enter the ETF arena in 2025.

- Active fixed income will come close to parity with passive fixed-income net flows in 2025 due to both increased adoption of active fixed income and the reallocation out of passive fixed income and to buffer/defined outcome ETFs.

- Canadian active ETF AUM eclipses US$150 billion by year end.

Europe predictions

As was the story in 2024, growth will continue to be a key theme.

We expect:

- The European ETF market will grow by at least 25 percent and surpass US$2.8 trillion in assets.

- New product launches will exceed 400.

- Actively managed ETFs will have the highest percentage of overall launches.

Expansion of issuers to the European UCITS ETF market, specifically with actively managed ETFs will be the story during 2025.

We expect:

- There will be a growth of ETF issuer-led and other new white label solutions to facilitate new issuers entering the market.

- A minimum of 10 new entrants will launch ETFs or expand from passive to active ETFs.

- The majority of these new entrants will be coming to market primarily with active strategies.

- At least two of the new entrants will do so by adding ETF share classes to an existing mutual fund range.

- Existing issues will use acquisition to gain additional scale, or traditional fund managers will use acquisition of an existing ETF issuer to enter the ETF market.

- Reduced portfolio transparency requirements will be expanded to Ireland (currently enabled in Luxembourg) with at least one manager leveraging the capability.

- Active ETFs will grow from 3 percent of AUM and 7 percent of flows to 4 percent of AUM and 10 percent of flows.

The utilization of listed and unlisted share class will expand with:

- A mutual fund manager expanding into ETFs by adding a listed share class to its unlisted fund range.

- An ETF issuer will expand into mutual funds by adding an unlisted share class to its listed ETF range.

Increased retail adoption via ETF savings programs, digital advice platforms and agreements between ETF issuers and neobrokers:

- Retail adoption will continue to accelerate, with ownership rates increasing from 20-25 percent to 30-35 percent across the Continent and the UK.

Digital asset expansion will be muted:

- At least one new entrant will launch a product in the Digital Asset ETP space.

- Digital asset growth will lag other jurisdictions based on crypto assets remaining an ineligible asset within the guise of the Eligible Assets Directive.

- The first issuer will receive approval to launch a tokenized ETF.

Asia-Pacific predictions

Australia

We expect dynamic growth:

- At least three US$100 billion asset managers will enter the ETF market.

- Net inflows will exceed US$30 billion.

- The cryptocurrency market will be expanded by at least one new coin.

China

2025 is the year that China overtakes Japan in size:

- The China ETF market will become the largest in the Asia-Pacific region.

- Assets under management will exceed US$700 billion.

Japan

Growth continues with at least two new global asset managers entering the ETF market.

South Korea

Demand for active will continue to drive this market and:

- Active ETFs will make up over 33 percent of the total ETF market.

- Total ETF assets will exceed US$150 billion.

Taiwan

Dynamic growth continues:

- At least five asset managers will launch active ETFs.

- Total ETF assets will exceed US$250 billion.

- ETFs will encompass 75 percent of the investment trust fund market.